Let us have a look at just one aspect of this most complex accounting standard; and perhaps the most examinable aspect – the accounting for financial liabilities at amortised cost. While it is possible that in certain circumstances financial liabilities can be accounted for at fair value through profit or loss (FVTP&L), the default treatment for financial liabilities is to account for them at amortised cost.

As an aside, this means we have a mixed measurement system for financial liabilities (the use of the cost model for some and fair value for others), which is something we are used to seeing for assets (e.g. IAS16 PPE and IAS 40 Investment Properties give a choice between the cost model and revaluing asset to fair value).

Initial recognition

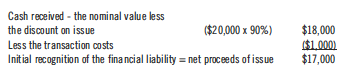

Financial liabilities that will be accounted at amortised cost are initially recognised at the fair value less issue costs i.e. at the net proceeds of issue less the issue costs.

Subsequent accounting for financial liabilities at amortised cost

The accounting for a financial liability at amortised cost means that the liability’s effective rate of interest is charged as a finance cost to the statement of profit or loss (not the interest paid in cash) and changes in market rates of interest are ignored – the liability is not revalued at the reporting date.

In simple terms this means that each year the liability will increase with the finance cost based on the effective rate and decrease by any cash repaid (which will be the coupon rate x the nominal value of the debt). Let us see that applied and explained in a question:

Question: Klopp raises finance by issuing $20,000 6% four-year loan notes on the first day of the current accounting period. The loan notes are issued at a discount of 10%, and will be redeemed at a premium of $1,015. The effective rate of interest is 12%. The issue costs were $1,000.

Required: Explain and illustrate how the loan is accounted for in the financial statements of Klopp.

Answer: Klopp is receiving cash that is obliged to repay so this financial instrument is correctly classified as a financial liability. As is perfectly normal, the liability will be classified and accounted for at amortised cost and thus initially measured at the fair value less the transaction costs.

Initial recognition

With both a discount on issue and transaction costs the first step is to calculate the initial measurement of the liability.

Subsequent accounting

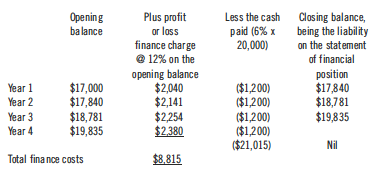

In then applying amortised cost, the finance cost to be charged to the statement of profit or loss is calculated by applying the effective rate of interest (in this example 12%) to the opening balance of the liability each year. The finance cost will increase the liability.

Dr Finance cost in the profit & loss a/c

Cr Financial liability in the statement of financial position

The actual cash is paid at the end of the reporting period and is calculated by applying the coupon rate (in this example 6%) to the nominal value of the liability (in this example $20,000). The annual cash payment of $1,200 (6% x $20,000 = $1,200) will reduce the liability.

Dr Financial liability in the statement of financial position

Cr Cash asset in the statement of financial position

In the final year there is an additional cash payment of $21,015 (the nominal value of $20,000 plus the premium of $1,015) which extinguishes the remaining balance of the liability.

The workings for the liability being accounted for at amortised cost can be summarised and presented as follows.

Because the cash paid each year is less than the finance cost, each year the outstanding liability grows and for this reason the finance cost increases year on year as well.

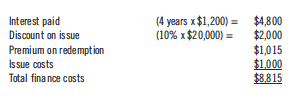

The total finance cost charged to income over the period of the loan comprises not only the interest paid, but also the discount on the issue, the premium on redemption and the transaction costs.

As always, it is important that you are able to explain the accounting treatment, as well as being able to illustrate it and apply it with numbers. You should now be able to do this for financial liabilities at amortised cost!

• Tom Clendon delivers online courses for ACCA SBR with FME