October 2022

Teresa Clarke explains how to calculate the payback period for a project.

The payback period is the length of time it takes to ‘get your money back’. I would always recommend using a table to calculate this, even if the task does not require it. It helps to work out the correct answer and avoid errors.

Here is an example.

Ricardo is planning a new project which will involve him purchasing a new machine for £100,000. It will bring him the following net cash inflow. This means the amount of income less any costs each year.

Year 1: Net cash inflow £25,000

Year 2: Net cash inflow £30,000

Year 3: Net cash inflow £40,000

Year 4: Net cash inflow £20,000

Question: What is the payback period for this investment?

In other words, how long will it take Ricardo to get his money back?

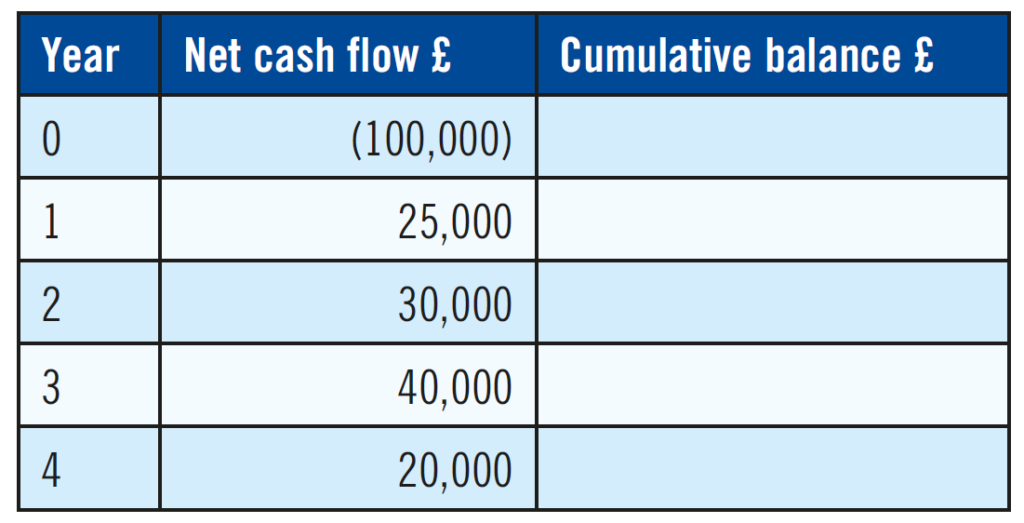

We put all the information in a table first.

Note, that year 0 means today or the first day of the investment, year 1 is the net cash flow for the first year, year 2 is the net cash flow for the second year, etc.

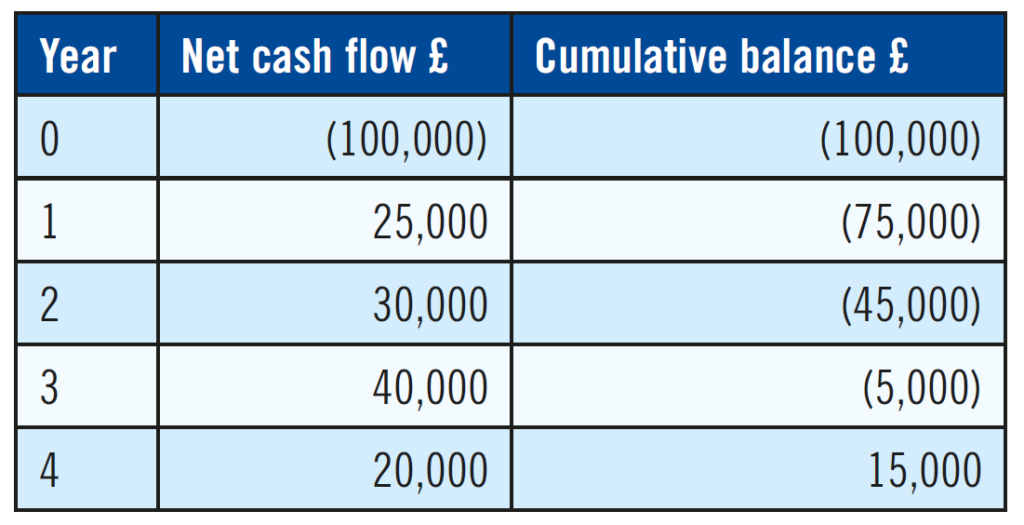

Now I can work out the balance at the end of each year. Year 0, or the first day of the investment starts with the £100,000 investment, so this gives a cumulative balance or running total of minus £100,000.

Year 1 is at the end of the first year. I add this to the cumulative balance.

I have added the cumulative balance in the table right.

You can see that after the four years, we have a positive number, making money on top of the initial investment.

To find the payback period in years and months, we are looking for the point at which the balance equals zero.

We have a payback period of three years and some months. Now we must work out exactly how many months into year four that the initial money is paid back.

Note: There are various ways of working this out so if you have your own method and it works, please use it. There are no wrong methods if they get to the correct answer.

At the end of year 3 we still had £5,000 to payback of the initial investment.

During year four we had a net cashflow of £20,000. That was for 12 months, so we need to work out how much net cashflow was received each month.

(£20,000 / 12 months) = 1 month’s cashflow.

£1,667 (rounded) = 1 month’s cashflow.

Now we can work out how many months of cashflow will take us to the point of zero, or the point at which the initial investment has been paid back.

Amount to clear / 1 month’s cashflow = months. £5,000 / £1,667 = 3 months.

Note: You always round up for the number of months as the payback would be at the end of the month.

Answer: Three years and three months

If you like my style of teaching, you may like my workbooks. Payback periods and other long-term decision-making topics can be found in my Long-Term Decision-Making Workbook. See https://www.amazon.co.uk/dp/B08Z9W11W6

All my workbooks are available from Amazon in paperback and as e-Books at very reasonable prices. You can use this link to find them – https://www.teresaclarke.co.uk/books/

• Teresa Clarke FMAAT