February 2023

Clive Webb explains how accountants can grasp the nettle when it comes to driving organisational change.

Planning, budgeting and forecasting are core activities for many finance teams.

Their complexity will vary according to the size of the organisation and the nature of its business; however, the core purpose remains to help leaders to anticipate the period ahead and to determine, for example, where investment might be needed to sustain growth or to develop new areas of operation.

Organisations thrive on certainty and the ability to plan accordingly. The early 2020s have seen significant disruption for many aspects of organisations. Interest rates have sharply increased from a decade of historic lows.

Consumer behaviours have changed, initially because of the pandemic but subsequently due to the increased cost of living and lower disposable income. In certain times an annual plan may well have been achievable for most organisations and the role of the finance team was to monitor performance against this plan, including using techniques such as variance analysis.

The level of uncertainty that organisations now face mean that they need to adapt their traditional approaches to planning and performance management. In their recent report ACCA and Chartered Accountants Australia and New Zealand, in association with PwC, explored the opportunities that finance teams have in enabling their organisations to navigate these uncertain times. Modelling more than one scenario and integrating this with assessment of risks is essential.

The overarching change that organisations need to make is to the culture that supports this activity. Those organisations that are agile and flexible will be more likely to succeed. Annual plans need to be replaced by rolling plans that are refined as the circumstances change. Only 6% of the nearly 3,000 global respondents to a survey for this research felt that they were agile, with 51% saying that it was a medium-term goal.

An effective plan is one that embraces all aspects of the organisation. Finance cannot be a silo, rather it needs to work collaboratively with other functions to develop and monitor one integrated plan. Likewise in understanding performance, it is a cross-functional activity where finance teams provide an understanding of the drivers. Simple variance analysis is no longer sufficient – what the functional leaders expect is an analysis of the variation from the plan and a view as to whether the circumstances will repeat. The role of the finance business partner in driving performance is an essential aspect of the finance team of the future.

To successfully achieve this forward looking and agile planning process the organisation needs to maximise its use of data and technology. We all generate significant amounts of data. How organisations use that data to understand customer behaviour and hence to manage their supply chains is essential. Finance cannot see its data in isolation. The forward-looking finance team embraces data from across the organisation and uses analytics to model the drivers of performance.

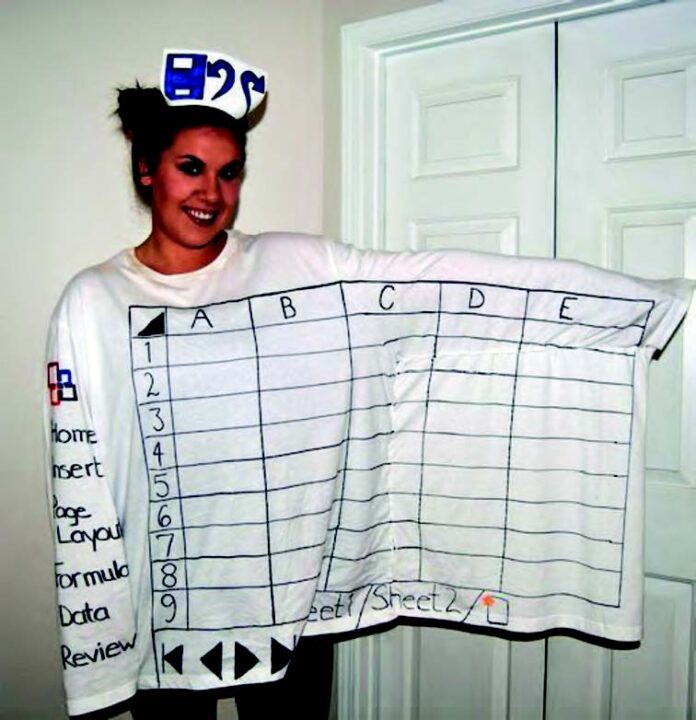

The technology that the organisation uses to deliver these insights is key. In a survey conducted as part of the research, 82% of respondents said that they used spreadsheets as their main planning and performance management tool. Only about 13% suggested that they used Cloud-based alternatives, with 53% not using them at all. There are several reasons behind this but if finance teams don’t embrace tools which enable them to understand and predict trends in a robust manner, then they run the risk of being marginalised. That‘s not to say that there’s no role for spreadsheets, rather that role needs to part of the overall technology and data architecture. The finance professional of the future is comfortable with data and technology and how it can be used to tell the story of performance.

But what is performance itself? Traditionally, finance teams solely considered the financial impact. Now stakeholders are looking at a broader agenda than a pure financial one.

Larger organisations, for example, are subject to environmental, social and governance (ESG) ratings as well as traditional credit ratings.

If we’re to reflect how external stakeholders assess an organisation, then the ESG drivers also need to be part of the internal performance management systems. The good news is that 82% of the survey respondents accepted that there is a need for a broader view of external performance in the next three to five years. Very few, only 4%, felt that their organisation had achieved this already. The finance professional of the future needs to have a broader view of the performance drivers and how data can be used to improve decision-making.

There are significant opportunities for finance teams to drive performance in challenging times.

Having the skill set to deliver upon this is vital for the finance professional of the future.

• Clive Webb is Senior Subject Manager – Business Management at ACCA