November 2020

Future Connect Training’s Mushtaq Ahmed looks at the Annual Accounting Scheme.

What is the Annual Accounting Scheme?

• The Annual Accounting Scheme is designed to reduce paperwork and help businesses with their budgeting and cash flow (Kashflow. com).

• Usually, VAT-registered businesses submit their VAT Returns and payments to HM Revenue and Customs 4 times a year.

From 1 April 2019, most businesses needed to keep digital VAT records and use software to submit VAT Returns.

When you submit your VAT Return you either:

i. Make a final payment – the difference between your advance payments and actual VAT bill.

ii. Apply for a refund – if you’ve overpaid your VAT bill.

iii. The scheme would not suit your business if you regularly reclaim VAT because you’ll only be able to get 1 refund a year.

Eligibility – you can join the Annual Accounting Scheme if:

• You’re a VAT-registered business.

• Your estimated VAT taxable turnover is £1.35 million or less in the next 12 months.

• VAT taxable turnover is the total of everything sold that is not VAT exempt.

If your taxable turnover is more than £1.6 million, you must leave the scheme ASAP.

Exceptions – you cannot use the scheme if:

• You left the scheme in the last 12 months.

• Your business is part of a VAT registered division or group of companies.

• You are not up to date with your VAT Returns or payments.

• You are insolvent.

How to join the scheme:

• Online – when you register for VAT.

• By post – fill in VAT600 AA and send it to the address on the form.

Confirmation you’ve joined the scheme is sent to your VAT online account (or in the post if you do not apply online).

How to leave:

• You can leave the scheme at any time, but you must leave if you’re no longer eligible.

• To leave, write to HMRC and they will confirm when you can leave. From this date, you must account for your VAT in the usual way.

• You have to wait 12 months before you can re-join the scheme.

VAT return

VAT Return deadline:

• There are 12 months in your VAT accounting period.

• Your VAT Return is due once a year, 2 months after the end of your accounting period.

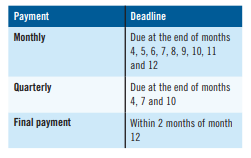

Payment deadlines:

• You must make advance payments towards your VAT bill (either monthly or quarterly).

How much do you pay?

Each payment is either:

• 10% of your estimated VAT bill (monthly payments).

• 25% (quarterly payments).

• The amount is based on previous VAT returns (or estimated if you’re new to VAT).

• HMRC will write telling you when your instalments are due and how much they’ll be.

• The final payment (known as a ‘balancing payment’) is the difference between your advance payments and the actual VAT bill confirmed on your VAT Return.

• You may be due a VAT refund if you’ve overpaid HMRC. (Gov.uk)

Pros & cons

The Advantages:

• Less paper work involved.

• File report once in a year.

• Easy to manage the cash flow.

• An extra month to complete the VAT return.

• Calculation is easier, especially for partially, exempt or for Retail Scheme.

• Reduction in number of VAT returns from FOUR to ONE.

The Disadvantages:

• Payments may be higher as it based on previous Year’s Performance.

• If the difference proves too significant than interim payments can be adjusted.

• Seasonal or other variations may have an adverse effect on cash flow.

• You are obliged to tell HMRC if your tax liability is projected to be much higher or lower than previous year.

• Mushtag Ahmed is accounts training manager at Future Connect Training.