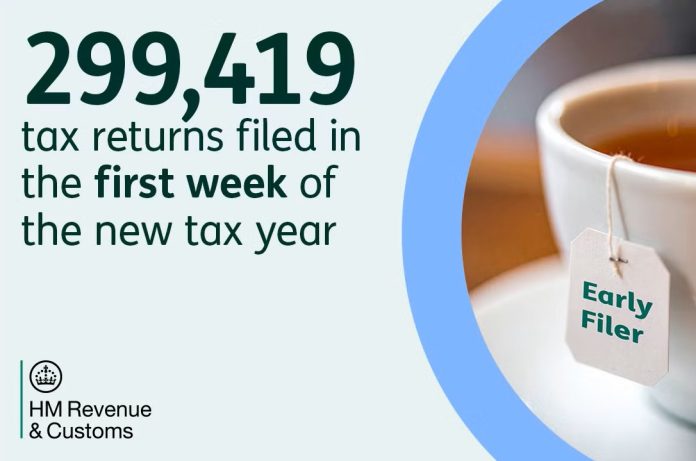

A record 299,419 self assessment returns were filed in the first week of the new tax year in the UK. That is a new record, and 10 months ahead of the next deadline!

HMRC said there were 57,815 early filers on the opening day, which was a Sunday

People may need to complete a tax return for the 2024 to 2025 tax year and pay any tax owed if they:

- Are newly self-employed with a total income over £1,000.

- Are self-employed and earn below £1,000 and wish to have Class 2 National Insurance contributions treated as paid.

- Have received any untaxed income over £2,500.

- Are renting out one or more properties.

- Claim Child Benefit and they or their partner have an income above £60,000.

- Are a partner in a business partnership.

- Have taxable income earned from savings and investments more than the £10,000, and have dividend income of more than £10,000.

- Have Capital Gains Tax to pay on assets that were sold for a profit above the Capital Gains threshold.

A full list of who needs to complete a tax return is available on GOV.UK.