May 2021

Tom Clendon looks at the principle behind goodwill.

In the olden days of face-to-face teaching, questions would be shouted out to me by a student with their arm raised up.

In this digital age my online students ask me questions by WhatsApp.

As keyboard warriors they are much braver – and so in my experiences online teaching creates more engagement rather than less. But I digress. My responses to these WhatsApp questions are sometimes voice notes and sometimes text.

This weekend I composed a reply to a cracking question as I wanted to use numbers to help reinforce my point. I often share my answers on my WhatsApp groups, but I thought I would share this one with all PQ readers.

The question

The question was this: please could you clarify why when NCI is measured as a proportion of net assets that the goodwill arising is only attributable to the parent company. I know this is true, but I just don’t understand why. Could you please explain?

My answer

Good question. I love that the questioner wants to really understand the principle behind this.

First, let me just reiterate. It is true that when NCI is measured as a proportion of net assets that the goodwill arising is only attributable to the parent company.

The significance of this means that the impairment loss on the goodwill will only reduce group retained earnings and none will be charge to the NCI. It also means when we are dealing with group exchange differences on the retranslation of such goodwill, there will also be no impact for NCI.

Let me illustrate with numbers to make sure that we all understand why this is the case.

Illustration:

Let’s take an 80% investment in a subsidiary that cost $200 and where NCI was measured as a proportion of the net assets which were $100.

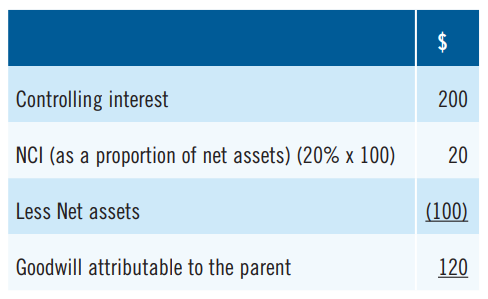

The correct way to calculate goodwill is as follows:

However, please consider the following explanation of how that $120 goodwill has arisen.

The parent has paid $200 for the controlling interest in the subsidiary. It has paid $200 for an 80% stake in the $100 net assets of the subsidiary. So the parent has paid $200 and in return has only got a share of net assets of $80 (80% x $100). So when we compare what the parent paid ($200) with what the parent has got in return ($80) we see that the premium, the goodwill that it has paid for is $120. This goodwill of $120, ignores the existence of the NCI, and just concentrates on the parent’s perspective. This proves therefore that when NCI is measured at acquisition as a proportion of net assets the goodwill arising is proportional in that it just belongs to the parent and none is attributable to the NCI. (Read that again – read it out loud – it should make sense).

Conceptual inconsistency

I give you this explanation to give you absolute certainty that when NCI is measured as a proportion of net assets, the goodwill is attributable to the parent only. You can now reflect that this is horribly inconsistent with the way that we account and consolidate all the other assets of the subsidiary as they are cross cast in full and have NCI attributable to them.

A final thought. It still remains the case that where NCI is measured at fair value then the goodwill arising will be in full and so any impairment loss or exchange difference on such goodwill does impact the NCI accordingly.

• Tom Clendon is an online lecturer teaching SBR. He loves WhatsApp and can be messaged on 07725 350793. See www.tomclendon.co.uk