November 2020

Gareth John explains everything you need to know about how a reconciliation works.

A typical accounting system might be dealing with enormous numbers of transactions every year; cash and credit sales, purchases, wages, rent, interest received, bank loans repaid… the list goes on and on.

Any errors that arise with any of those transactions can have a serious impact on the accuracy of the financial statements produced at the end of the accounting period.

Accountants therefore like to have a variety of checks in place to try to spot errors that have been made so that they can be corrected. One such check is a reconciliation.

A reconciliation is where we compare two balances from different places in our accounting records that we know should be the same figure.

If they are not the same then we know that we need to make some adjustments. For example, a bank reconciliation is where we compare the balance on the cash account in our nominal ledger with the balance on the bank statement to see if they give the same figure.

Sales Ledger Control Account reconciliation

Let’s consider a sales ledger control account reconciliation where we compare the balance of the sales ledger control account (SLCA) with the total of the list of individual customer account balances in the sales ledger. This is to ensure that the trade receivables figure that we show on our balance sheet is correct.

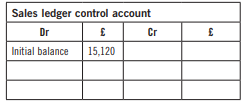

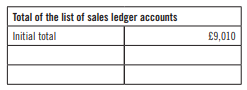

Here’s an example:

The balance on the SLCA has been compared with the total of the list of sales ledger accounts to see if they agree. The balance showing on the SLCA is £15,120 and the total of the list of sales ledger balances is £9,010. They don’t agree, so something must have gone wrong somewhere.

After a bit of investigation the following five issues have been identified:

1: The sales ledger column in the cash receipts book was totalled as £5,400 when it should have been £4,500.

2: A contra for £1,000 was only recorded in the sales ledger.

3: A credit note for £600 in the sales returns day book was not posted to the sales ledger.

4: A total in the sales day book of £790 was recorded in the nominal ledger as £7,900.

5: A balance of £500 was duplicated in the sales ledger listing.

In order to deal with the five issues I think it’s a good idea to consider the starting position that we have in the two records that we are comparing, perhaps noting them down on a piece of paper.

Sales Ledger Control Account

The SLCA records the total amount owed to us by all of our credit customers. It is part of the nominal ledger so can be shown as a T-account. Since the SLCA records the asset of receivables of the business the balance would be a debit:

Sales Ledger

The sales ledger is where we keep a record of the amount that each individual credit customer owes us. If we add up all of those individual account balances to give a total, it should be the same as the balance on the SLCA. In this example it is different by several thousand pounds.

The sales ledger is not part of the double entry system used in our nominal ledger so we don’t normally show it in the form of a T-account.

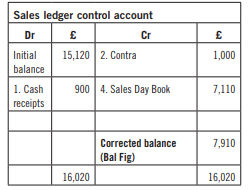

We can now consider each of the five issues that were identified.

The key when looking at each issue is to work out which of our two records is wrong and how it then needs to be corrected.

Let’s look through each difference in turn.

1: The cash receipts book is one of the books of prime entry (BOPEs). We know that the nominal ledger includes all of the totals from the BOPEs. If total of cash receipts from credit customers in the BOPE is wrong, the SLCA will also be wrong. Customer receipts reduce the balance owed by customers so if they were too high by £900, the SLCA balance will be too low. Therefore, to correct the issue we need a debit on the SLCA.

2: A contra entry for £1,000 is missing from the sales ledger control account. A contra is where we offset balances on the sales ledger control account with balances on the purchase ledger control account to reduce both balances. Therefore, to add the missing contra and reduce the receivables figure we need a credit on the SLCA.

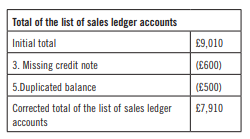

3: Issuing a credit note reduces what a customer owes us. If one is missing from the sales ledger then the total of the list of balances will be too high. Therefore, to account for the missing credit note we need to reduce the total.

4: The sales day book is another BOPE. This error will have resulted in too large a credit sales figure being debited to the SLCA. Therefore, we need a credit of the difference of £7,110 to correct this.

5: If a balance on the sales ledger was duplicated (included twice) the total of the list of balances will be too high. Therefore, we need to reduce the total.

Showing how each of the five issues need to be corrected we get:

You can see that the corrected balance on the SLCA now equals the list of sales ledger accounts, both giving the same figure of £7,910. They now reconcile!.

• Gareth John is Chief Executive of First Intuition Cambridge.