May 2023

Jo Tuffill shakes up the WACC calculation using a performance management technique.

Formulae feature pretty heavily in the ACCA FM and PM syllabi and tend to send many students into a spin with memories of dreaded school algebra lessons. Let’s face it, accountants really need to be numerical, not mathematical.

Taking FM as an example; here is one way of throwing out that WACC’y formula.

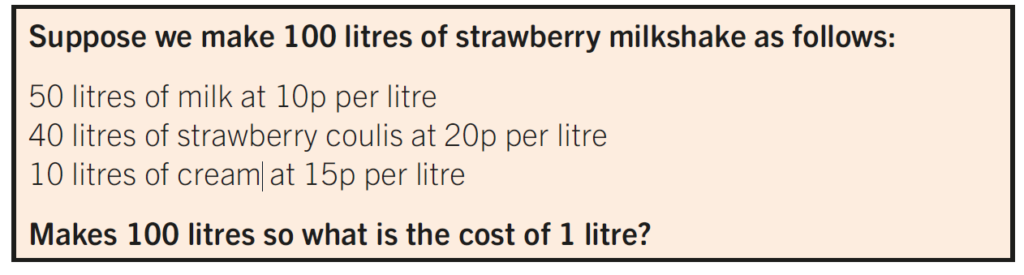

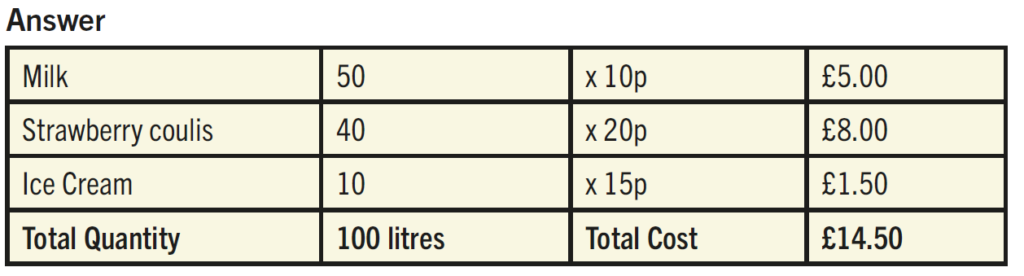

The weighted average cost of capital is basically like costing up a strawberry milkshake, you know the ones from your local coffee shop that vary in both quality and cost.

Weighted Average Cost per litre will simply be £14.50 / 100 = 14.5p

Now if you vary the mix keeping the total quantity fixed you can manipulate the cost. Adding more milk and less strawberry coulis will push down the cost per litre, and vice versa. We know from PM mix and yield variances, that varying the mix from the standard mix, will create either a more expensive or less expensive mix. This technique can be applied to FM and calculating the cost of capital.

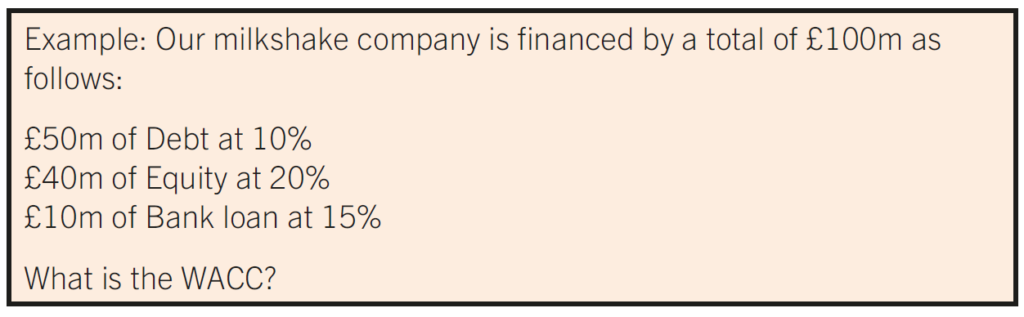

Here is the trick.

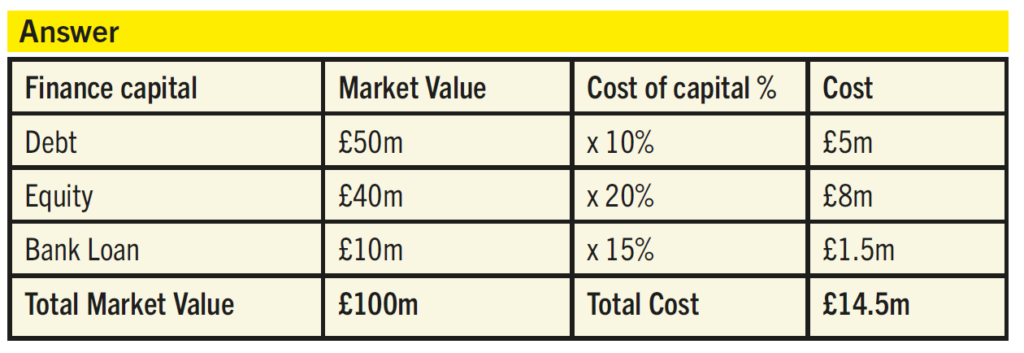

When asked to calculate a WACC, replace the quantity in litres with Market Values of Finance and the cost in pence with their respective % Cost of Finance.

WACC will simply be £14.5m / £100m = 0.145 or 14.5%

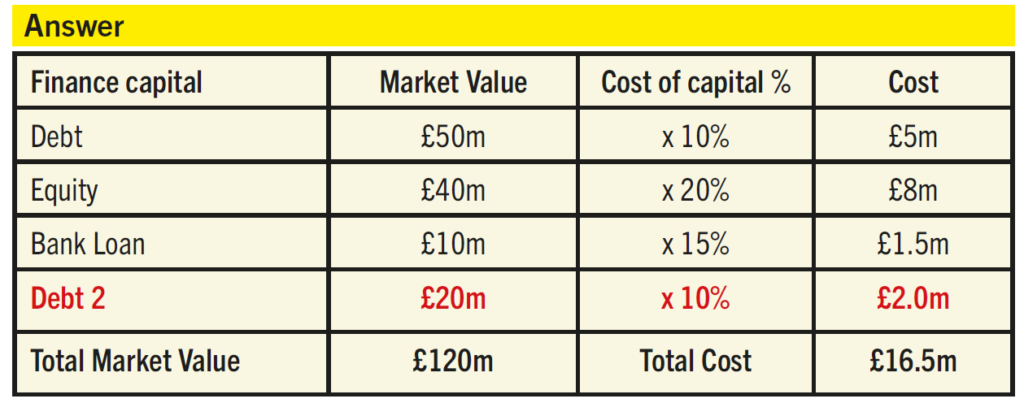

Again, if you add another source of finance you will vary the mix and manipulate the WACC. Adding more debt at a lower cost of capital will push down the WACC as follows:

WACC will simply be £16.5m / £120m = 0.1375 or 13.75% which is lower. So no formula required!

Leave it on the formula sheet.

- Jo Tuffill is a Management Accounting tutor at FME Learn Online