October 2021

Karen Groves explains how to approach a flexed budget exam-style question and tests your knowledge on the subject.

Budgeting is assessed at AAT Levels 2, 3 and 4, and is therefore a very important part of the syllabus. At Level 2, only a basic level

of knowledge is required; however, you will still be required to calculate budgeted costs and compare budgeted costs to actual costs.

By setting a budget, this helps a business to manage sales and costs and helps managers control the business. The budget is based on what you expect to happen in a future period, for example, next month.

As an AAT tutor I get many questions on this topic, especially on flexed budgets, which can cause confusion.

We will look at an example question, and the way this should be approached.

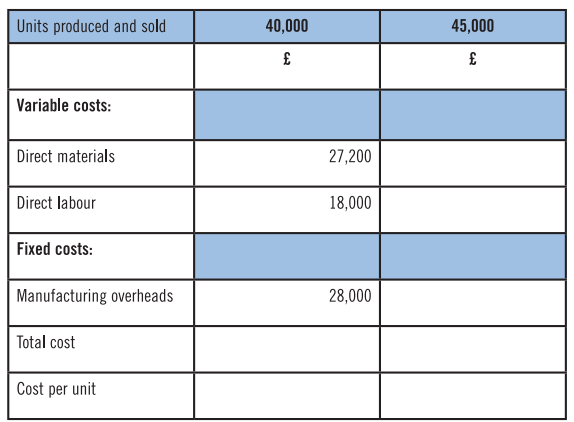

Example The following budget information has been provided for the month of October 2021. Variable costs for both direct materials and direct labour have been entered based on a production level of 40,000 units. Manufacturing overheads are a fixed cost. You are required to calculate a revised budget based on a production level of 45,000 units, as sales demand is likely to be higher than first budgeted and more units are therefore required.

The first step is to complete the budget columns for the 40,000 units as follows:

Note: Calculate the cost per unit to three decimal places.

Total cost = £27,200 + £18,000 +£28,000 = £73,200

Cost per unit = £73,200 / 40,000 Units = £1.830

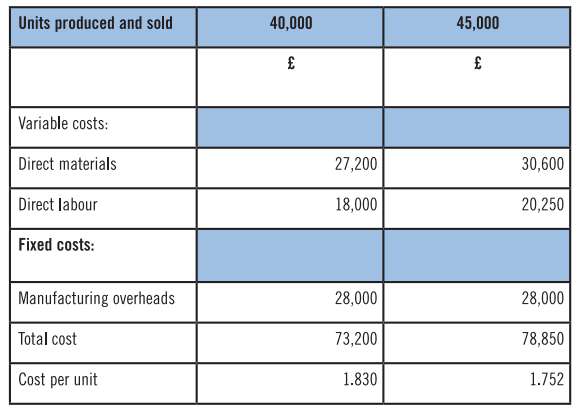

We can then complete the budget for a produciton level of 45,000 units as follows:

Direct materials £27,200 / 40,000 units x 45,000 units = £36,600

Direct labour £18,000 / 40,000 units x 45,000 units = £20,250

Manufacturing overheads are fixed and therefore remain the same (do not flex this cost!) Total cost = £30,600 + £20,250 + £28,000 = £78,850 Cost per unit = £78,850 / 45,000 units = £1.752

Now have a go!

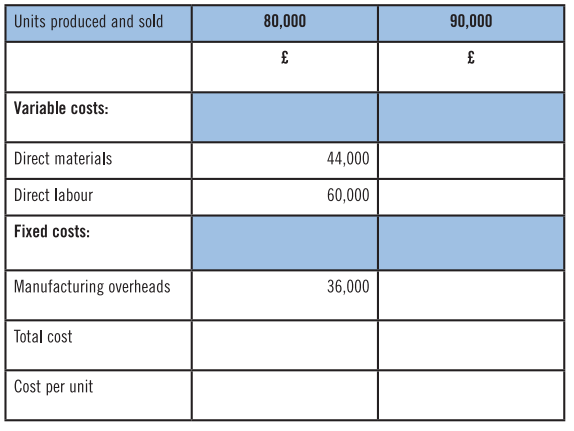

The following budget information has been provided for the month of November 2021. Variable costs for both direct materials and direct labour have been entered based on a production level of 80,000 units. Manufacturing overheads are a fixed cost.

You are required to calculate a revised budget based on a production level of 90,000 units. Note: Calculate the cost per unit to three decimal places

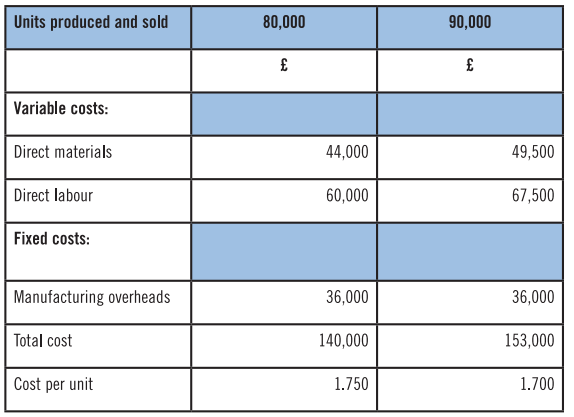

Answer:

Workings: 80,000 units: Total cost = £44,000 + £60,000 + £36,000 = £140,000 Cost per unit = £140,000 / 80,000 units = £1.750 90,000 units: Direct materials £44,000 / 80,000 units x 90,000 units = £49,500 Direct labour £60,000 / 80,000 units x 90,000 units = £67,500 Manufacturing overheads are fixed and therefore remain the same

Total cost = £49,500 + £67,500 + £36,000 = £153,000 Cost per unit = £153,000 / 90,000 units = £1,700

• Karen Groves is an AAT tutor and AAT Course Director at e-Careers. Get in touch with her via e-Careers.com or call 020 3198 7600