May 2024

Karen Groves explains how to approach a budgeting and variance exam-style question and tests your knowledge on the subject.

Budgeting and variances are assessed at AAT Levels 2, 3 and 4. At Level 2, only a basic level of knowledge is required; however, you will still be required to calculate variances and identify if these are adverse or favourable.

Budgeting helps a business to manage sales and costs and helps managers control the business. The budget is based on what you expect to happen in a future period, for example, next month. The budget is then compared with the actual amounts and any difference, or variance, can be investigated to identify the cause. For example, an increase in material cost could be due to a shortage nationally of materials, which in turn, has increased the purchase price.

A favourable variance occurs when our costs are lower than expected or our sales are higher than expected. A favourable variance will increase profits.

An adverse variance occurs when our costs are higher than expected or our sales are lower than expected. An adverse variance will decrease profits. As an AAT tutor, I get many questions on how to calculate the variances, with students getting confused on which figures to base their calculations.

We will look at an example question, and the way this should be approached.

Example

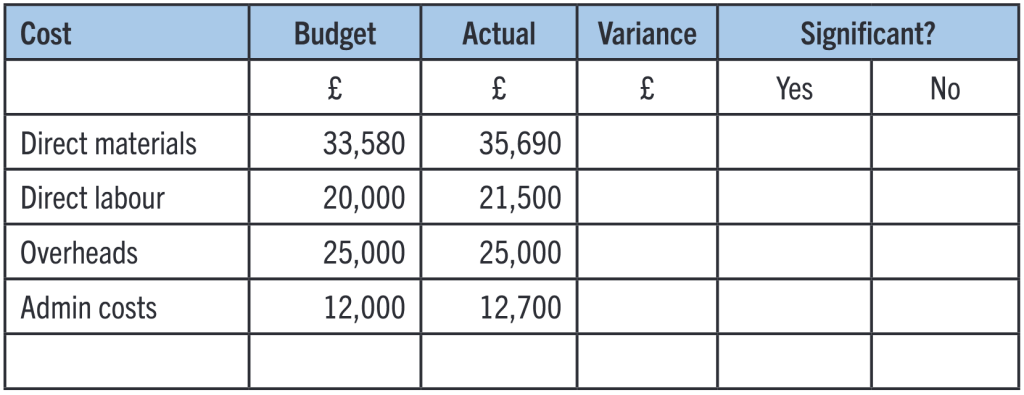

The following information has been provided for the month of April 2024, detailing budgeted and actual costs for the month:

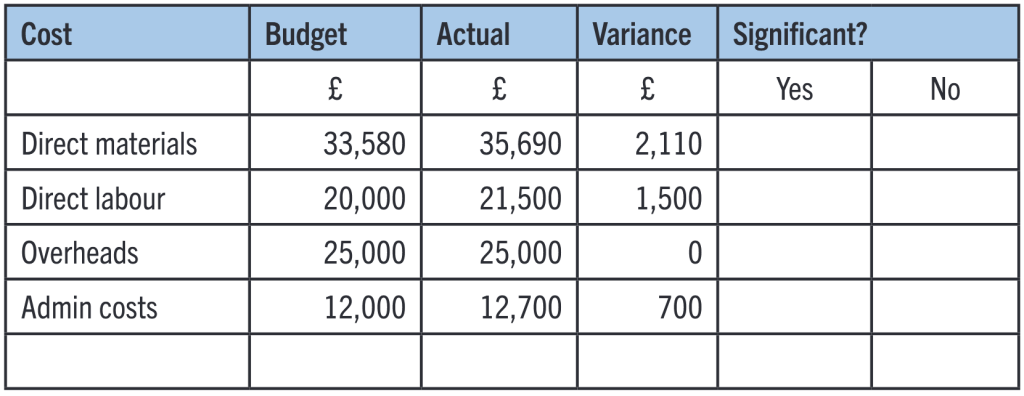

The first step is to calculate the variances as follows, being the difference between the budget amount and actual amount, for example:

Direct materials £33,580 – £35,690 = £2,110

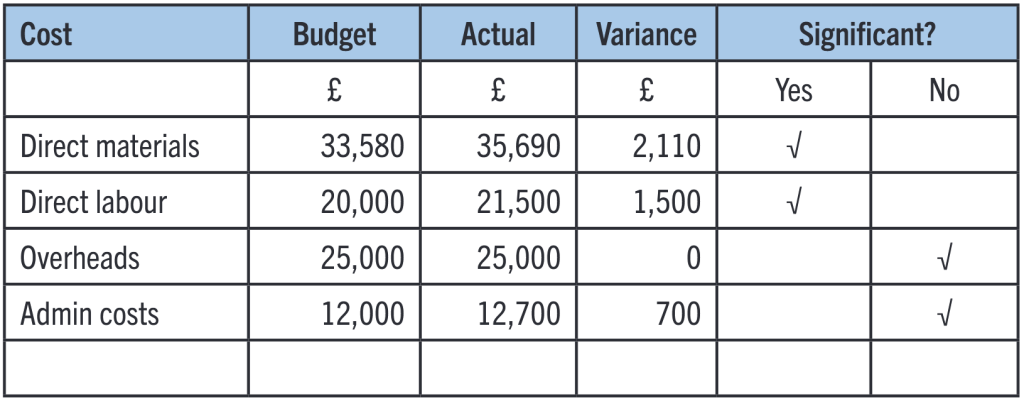

We are advised that any variance greater than 6% of budget is considered to be significant and should be investigated further. The next step is to calculate the variance percentage, as follows, being the variance amount divided by budget x 100, for example:

Direct materials £2,110 ÷ £33,580 x 100 = 6.28%

Direct labour £1,500 ÷ £20,000 x 100 = 7.5%

Overheads – 0%

Admin costs £700 ÷ £12,000 x 100 = 5.83%

Note: In an exam question you may also be asked to show the percentage variance as calculated above, so be sure to take the variance amount and divide by the budget amount.

Now have a go!

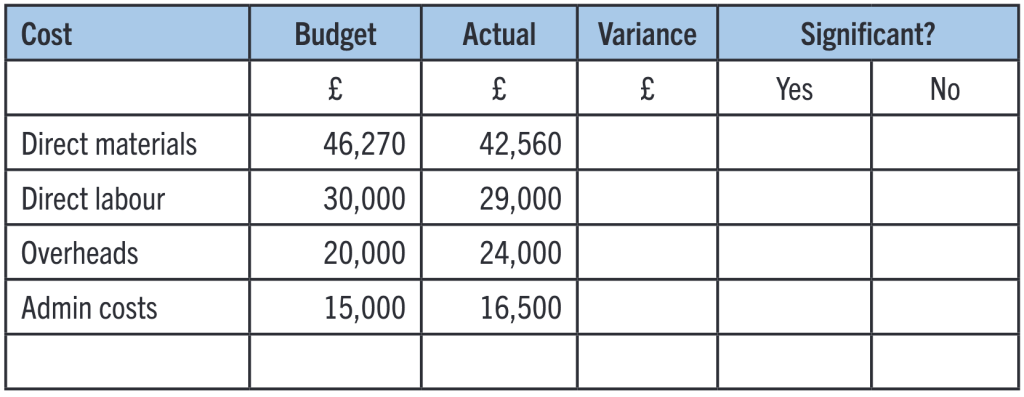

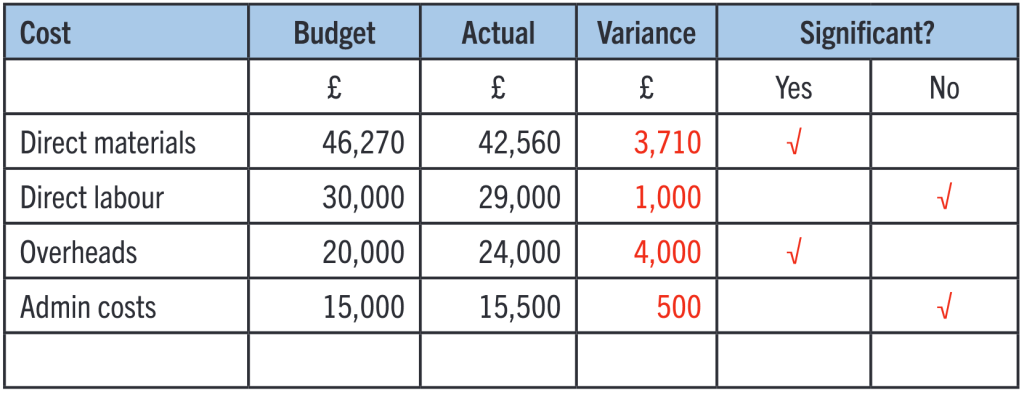

The following information has been provided for the month of May 2024, detailing budgeted and actual costs for the month. Any variance greater than 5% is deemed as significant and should be investigated further. Calculate the variances and identify if the variances are significant or not.

Answers:

Direct materials £46,270 – £42,560 = £3,710

Direct labour £30,000 – £29,000 = £1,000

Overheads £20,000 – £24,000 = £4,000

Admin costs £15,000 – £15,500 = £500

Direct materials £3,710 ÷ £46,270 x 100 = 8.02%

Direct labour £1,000 ÷ £30,000 x 100 = 3.33%

Overheads £4,000 ÷ £20,000 x 100 = 20%

Admin costs £500 ÷ £15,000 x 100 = 3.33%

- Karen Groves is an AAT tutor and AAT Faculty Director at e-Careers