January 2022

Michele Baker explains why understanding the calculations is the key to answering questions on mark up and margin.

Ok, calculators at the ready, this is going to be a good one. The Mark Up and Margin calculations aren’t too tricky – but understanding them can be.

Understand, don’t memorise

We’re all guilty of trying to memorise a calculation.

But until you understand the reason for it or what it tells you, that’s all it will be. You’ll have the answer but you won’t know what it means. Let’s have a look at them both.

Mark up

This is where we have the cost price, and to this we add the amount of profit we want to make.

So we start with a cost price and mark up that price to get the selling price.

Profit Percentage = 40%

Cost Price = 100%

Our starting point is the cost price so this will be equal to 100%. If our policy was to make a profit of 40%, we would need to add this to the cost price to find the selling price.

Margin

This is where we want to achieve a specific selling price. This means the profit made is determined by the selling price. The selling price includes the profit margIN and the cost price.

The selling price is therefore equal to 100%.

Profit Percentage = 40%

Cost Price = 60%

If we used the same profit percentage of 40% it would mean that the cost price is 60%.

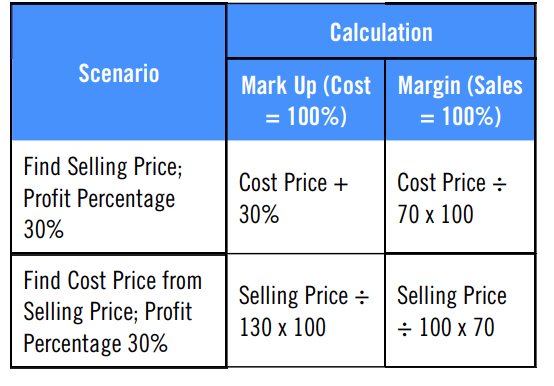

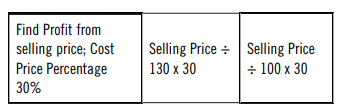

Calculations

Some of you may have watched my ‘Back to Basics’ video on VAT calculations. You can apply the same techniques to the mark up and margin calculations. Understanding the calculation is key!

If you can find 1% of a value you can find any percentage after that.

The number we divide by finds 1% of the value, we can then multiply this to find the percentage value we want.

Incomplete Records

In your assessments or exams, you might need to find a missing value. If you’ve got to grips with the calculations above, you’ll have no problem with this scenario.

We’ll work through an example now.

A businesses annual sales income is £987,000 and use a margin percentage of 15%.

From this limited information we can determine the cost of sales and gross profit.

Remember that if we’re looking at a profit margIN, the sales figure is equal to 100%. If we divide by 100, we’ll find 1%.

Cost of sales £987,000 ÷ 100 x 85 = £838,950

We could subtract the cost of sales from the sales, but I’m on a roll, humour me!

Gross profit £987,000 ÷ 100 x 15 = £148,050

You could even use the cost of sales figure to find the gross profit figure.

Cost of sales £838,950 ÷ 85 x 15 = £148,050

The pressure of an exam can make the calculations you’ve memorised disappear from your mind in an instant. I’d be lying if I said it had never happened to me. So, take the time to understand the calculations. It might take a little longer but it will make all the difference. Go into an exam confident of your understanding, not worrying about what you might forget!

• Michele Baker is a tutor at Training Link. She has been tutoring for 15 years and has contributed to PQ magazine’s Back to Basics video series