December 2020

Neil Da Costa shows you how best to tackle exam questions on group relief.

I am going to show you how to ‘keep it simple’. Having been an Advanced Tax lecturer for more than 20 years I am fully aware of which areas examiners say that students struggle with. These areas feature regularly in the tax exams and by ensuring you understand them you can be confident of earning these marks in the question. In this article I will be showing you how to deal with groups using a simple example.

Identifying group relief groups and related companies

Trading losses can be surrendered between companies in a group relief group. We need a strict 75% shareholding and all companies must be UK resident.

On the other hand, when identifying related companies, the shareholding only needs to be 51%. As the test is done at the end of the previous period, companies leaving the group are included as related companies. The threshold of £1,500,000 is divided by the number of related companies in the group.

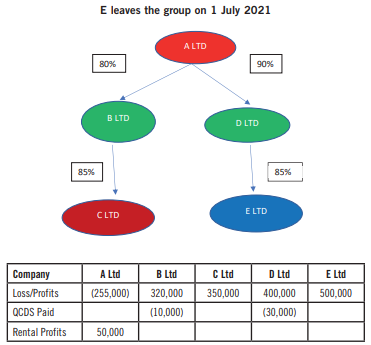

In the following group, all companies are UK resident and prepare accounts from 1 April 2021 to 31 March 2022.

This means that A Ltd, B Ltd, D Ltd and E Ltd are in a group relief group.

C Ltd is not in the group relief group because the indirect shareholding in C Ltd is only 80% x 85% = 68% which is less than 75%. E Ltd will be in the group for only 3 months (April 2021 -June 2021) because the company is being sold on 1 July 2021.

However, all five companies are related because both the direct and indirect shareholdings are at least 51%. The threshold for establishing the size of the company of £1,500,000 must be divided by five. £1,500,000 ÷ 5 = £ 300,000

Identifying the surrendering and claimant companies

The company that gives the loss is called the surrendering company.

The surrendering company has flexibility. It may use the loss itself under current year relief and surrender just the balance to other group members or it may choose to surrender the entire loss to group members.

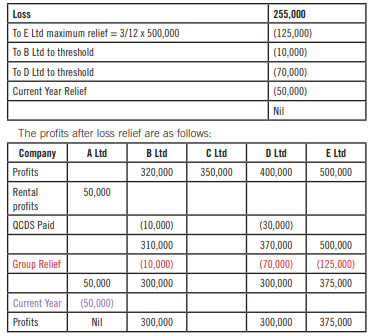

In this question, A Ltd is the surrendering company. It can use up (50,000) of the loss itself and surrender the balance of (205,000) as group relief or it may choose to give the entire loss of (255,000) as group relief. The company that takes the loss is called the claimant company. If a company leave the group, then only profits or losses before it leaves the group enter into the group relief.

In this question, B Ltd, D Ltd and E Ltd are the claimant companies.

As E Ltd is leaving the group after three months, only £500,000 x 3/12 = £125,000 are available for group relief.

How much group relief should you give?

Group relief can be given to any company within the group but should be given to bring large companies down to small, hence avoiding quarterly payments.

It is important to compare the profits after qualifying charitable donations (QCDs) with the threshold of £300,000.

B Ltd has profits after QCDs of £310,000 and needs group relief of £ (10,000) to avoid quarterly payments.

D Ltd has profits after QCDs of £370,000 and needs group relief of £ (70,000) to avoid quarterly payments.

A Ltd would therefore give group relief to E Ltd of £ (125,000), next £ (10,000) to B Ltd and finally £ (70,000) to D Ltd.

This would leave a remaining loss of (255,000 -125,000 -10,000 – 70,000) = £ (50,000) that A Ltd can use itself under current year relief.

Amazing! You have now understood groups and can easily pick up marks on this popular area in the exam.

• Neil Da Costa is a Senior Tax Lecturer with Kaplan.