September 2020

What do you need to know about the ACCA’s APM paper? Geoff Cordwell is just the man to tell you.

Variances were added to this syllabus a good few years ago and we have had a couple of questions since then, but there are still a number of juicy areas for the examiner to go at.

Variance calculations tend to be examined in the management accounting and performance management papers lower down in the ACCA’s scheme and so the examiner is much more likely to ask you to consider interpretation of variances (Cortina M/J 2019) or ask you to comment on flawed variance calculation systems (Godel Jun 2014).

This is in keeping with the high level of this paper and the long-standing desire of the examiner to deliver accountants to the market that can evaluate existing systems and encourage change for the better in performance management systems that they come across.

The question then becomes, I suppose, what sort of things go wrong in businesses that do use variance systems? Since, if we understand that, then we have a better idea of what type of exam question we might face in this examination. Equally, we might have a better idea of what to look for in our own employer’s systems when it comes to flawed variance reporting.

Let’s consider these systems of variances. In each case the existing system is described in italics and a second paragraph to explain what is wrong and what needs to be done.

Example 1

The budget for a fruit grower is produced late in the previous year and the total cost is divided by 12 to get a monthly budgeted cost. This is then compared to the actual cost each month to get a variance.

The main issue here is poor budget profiling

(or spreading). Surely this business is seasonal? This method of profiling will result in some months with favourable variances and some with adverse variance regardless of the quality of the actual performance. This completely undermines the budget and variances process.

Example 2

The budget for a meat importer is raised for the inclusion of an assumed exchange rate. Each month the original budget is compared to the actual cost and a variance calculated. The meat buyer’s performance is assessed from these numbers once a variance is calculated.

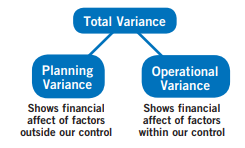

The main issue here is the problem with exchange rates. Exchange rates are a factor outside the control of most buyers and indeed most businesses. Factors outside the control of the responsible person should be formally adjusted in a “revised budget” splitting out the “planning error”.

Example 3

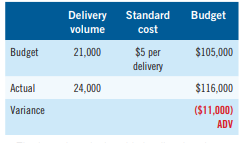

The budget for delivery costs in a postal business is set using standard costs and predicted delivery volumes. This budget is not adjusted for delivery volumes actually achieved as “The budget is the budget” as they say in this business. These are then compared to monthly actual costs to show the variance.

The issue here is that this implies that the budget is not adjusted for actual delivery volumes. This is known as not “flexing” the budget.

Had the budget been flexed the flexed budget

would have been: 24,000 x $5 = $120,000 and a favourable variance of $4,000 would have resulted.

This error is surprisingly commonplace in businesses and can be very misleading and demotivating for the staff being assessed.

Example 4

The business had a responsibility accounting system whereby all variances are allocated to those responsible for that area.

For example any material price variance is allocated to the buyer and any material usage variance is allocated to the production manager. This is not varied from month to month for consistency purposes.

In March the buyer bought poor quality and hence cheaper material. This was all used in production. The Material Price Variance was $5,000 Fav and the Material usage Variance was $8,500 Adv.

This has its positives. Variances should be allocated to responsible individuals. This makes it clear exactly who is responsible. However there is a dependency issue.

The actions of the buyer may have directly influenced the performance of the production manager and that is unfair. Poor quality materials can be more difficult to use or result in more waste.

This issue would need resolving, possibly by the reallocation, after due investigation, of some or all of the material usage variance back to the buyer.

When preparing for this paper think hard about what is wrong with traditional systems and form an opinion. It is very likely that you could be asked to evaluate a system in the APM exam so you should prepare for that.

• Geoff Cordwell is an ACCA APM Online Tutor with FME Learn Online. Go to www.geoffcordwell.com