January 2024

Tom Clendon (pictured) guides you through the options of how non-controlling interest (NCI) can be measured and the consequences to the measurement of goodwill and accounting for impairment losses.

So, what exactly is NCI? On the consolidation of a subsidiary, IFRS3 Business Combinations requires that where the parent has not acquired 100% of the shares in the subsidiary, then the other shares are termed the non-controlling interest (NCI). Thus, when the parent acquires a controlling interest and establishes a subsidiary by buying say 80% then the NCI will be 20%. Consequently, the post- acquisition profits and losses of the subsidiary are shared in this proportion.

To calculate goodwill, the NCI at the date of acquisition is introduced as a consolidation adjustment. This key ingredient in the calculation of the goodwill will also be part of the group’s equity and be increased by the NCI share of the subsidiary’s post-acquisition profits.

NCI at the date of acquisition can measured at either:

- fair value (FV), meaning the value is based on the market value of those shares and is said to give rise to full goodwill; or

- as a proportion of net assets, meaning it is measured based on the net assets at acquisition and is said to give rise to proportional goodwill.

Both methods are examinable, but it is always made clear in exam questions which measurement basis has to be used. What you need to understand, and be able to apply, is that the method chosen to measure NCI at acquisition will have a direct impact both on the measurement of the goodwill arising and how any impairment loss on that goodwill is accounted for.

NCI as used in the goodwill calculation

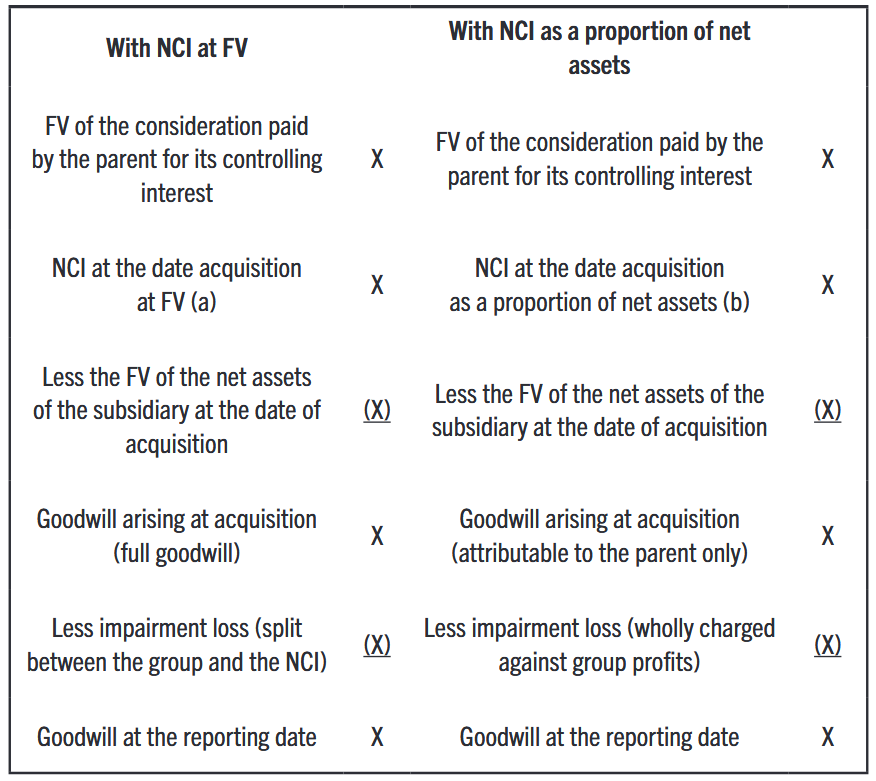

The following workings actually set out how NCI is used to calculate the goodwill and the consequences of using either method of measuring NCI at acquisition.

Let’s look at the calculations required to initially measure the NCI at the date of acquisition using each of the methods identified above and clarify the consequences when impairment losses have to be accounted for.

(a) NCI measured at fair value = goodwill in full = split the impairment loss with the NCI

The FV of the NCI at acquisition is measured by taking the shares in the subsidiary not owned by the parent and valuing them at their market value:

Because of measuring NCI at FV, the goodwill arising at acquisition is full goodwill; that is say goodwill is both attributable to the parent and the NCI. This means that when there is an impairment loss on full goodwill charged to the group profit & loss account, the NCI are impacted – so in the group statement of financial position, the parent’s share reduces group retained earnings and the NCI’s share reduces the NCI.

(b) NCI measured as a proportion of net assets = goodwill attributable to the parent = charge all the impairment loss to group retained earnings Alternatively, NCI at acquisition can be measured at their proportion of the subsidiary’s net assets.

Because of measuring NCI as a proportion of net assets the goodwill arising at acquisition is attributable to the parent only. This means that when there is an impairment loss on the goodwill, all the impairment loss is charged to the group profit & loss account – but in the group statement of financial position only the group retained earnings are reduced and none to the NCI.

Conclusion

So now you know the different ways to calculate NCI and the impact that it has on how impairment losses are accounted for, it is important that you go away and practice these calculations!

- Tom Clendon is an online ACCA SBR lecturer and podcaster. He loves WhatsApp – message 07725 350793. See www.tomclendon.co.uk