June 2020

Zahid Ahmed helps those studying tax get a better understanding of the mechanics behind pension contributions.

There are two types of pension schemes that you need to be aware of: occupational and personal. Let’s look at these two in more detail to understand how these schemes operate.

Occupational pension scheme (OPS)

The scheme is only available to employees and is set up by their employers. Both employees and employers make contributions to this scheme.

Should an employee pay into an occupational scheme, their contribution is deducted from their employment income, as such it reduces their employment income and income tax.

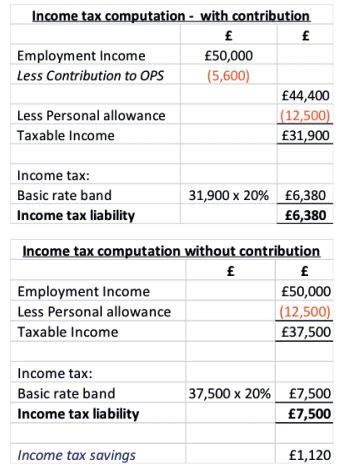

Let’s look at an example:

• Sufyan has employment income of £50,000

• He contributes to his occupational pension scheme run by his employer

• In the tax year 19/20 he contributed £5,600

How much income tax is saved if Sufyan makes the contribution?

As you can see, Sufyan will save £1,120 (7,500 – 6,380) in income tax; another way of looking at it is a saving of 20% of the contribution.

Personal pension scheme (PPS)

These schemes are run by pension providers and open to individuals, such as sole traders, and employed staff.

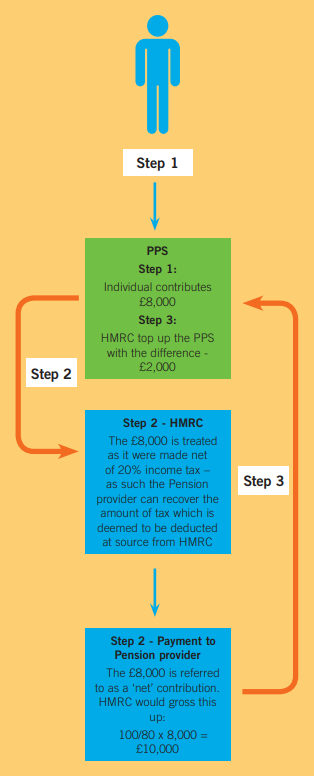

When an individual pays into a personal pension scheme the payment is treated as if it was made net of 20% income tax. Let us consider an individual who contributes £8,000 physically into their PPS:

As you can see, an individual would only need to contribute £8,000 into their pension scheme for the pot to have a value of £10,000.

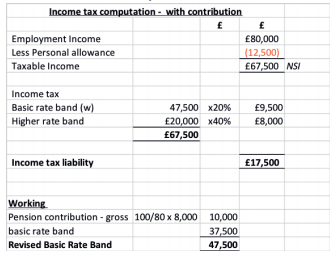

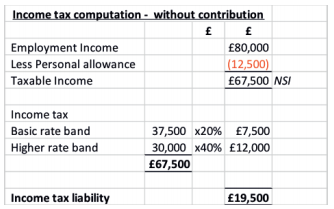

If you’re a basic rate taxpayer there are no further income tax implications. However, if you’re a higher or an additional rate taxpayer then your basic and higher rate bands are extended by the gross contribution (amount paid x 100/80).

Let’s look at an example:

• Daaniyaal has employment income of £80,000

• He makes a net contribution to his personal pension scheme of £8,000

• He has no other income in the tax year

How much Income tax is saved if Daaniyaal makes this contribution, and what is his income tax liability?

Daaniyaal will save £2,000 worth of income tax should he make a net contribution of £8,000. The savings can also be expressed as 20% x £10,000 (gross donation).

• Zahid Ahmed is a lecturer at LSBF