January 2023

Geoff Cordwell and Jo Tuffill talk you through activity based costing and activity based management.

Just how much do you need to know about activity based costing (ABC) and activity based management (ABM) in PM and APM? You might be studying PM, or you might have passed that and are looking at APM.

What is the dividing line for these topics between these two papers?

ABC focuses on producing accurate information about the true cost of products, services, processes, activities and customers. Using ABC, organisations gain a thorough understanding of their business processes and cost behaviour during ABC analysis.

ABM then applies this insight to improve decision making at operating and strategic levels. It considers how an organisation can use the basic ABC analysis to make change and improve.

Jo: a case study example

Jo starts with how it is examined in PM using a case study about a bicycle manufacturer.

Lottrechio Bikes is looking to introduce ABC to replace its Traditional Absorption Costing (TAC) system. With the introduction of electric bikes to its portfolio of products, the diversity and complexity of its products has changed and so not all overheads are driven by volume. As overheads are not all volume-related a single basis for absorption would not adequately reflect the complexity of producing electric bikes as opposed to conventional ones.

ABC specifically considers what causes each type of overhead category to occur, i.e. what the cost drivers are. Each type of overhead is then absorbed using a different basis depending on the cost driver.

Tackling ABC questions is like following a recipe there is a step process.

1: Identify the cost driver for the overhead cost pool.

2: Calculate the total number of cost drivers related to that cost pool.

3: Calculate an OAR (overhead absorption rate) for each overhead pool by dividing (1) by (2).

4: Absorb (3) on to each product based on how much each product uses of the cost driver.

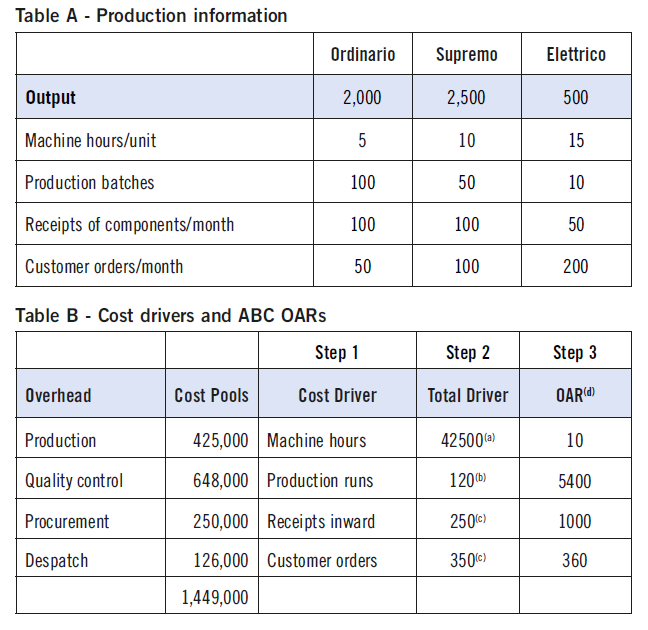

Lottrechio has three products – Ordinario, Supremo and Elettrico. All the bicycles were independently designed with slight differences in most components, including even pedals and handlebars. The production information for one month is shown in the table A below:

Notes

a. Calculated by output x machine hours per unit for each product and then total

b. Find the number of production runs per month by demand/batch and then total

c. Total for three products for the month

d. Cost pool divided by total driver – e.g. production $425,000/42500 hours = $10 per hour

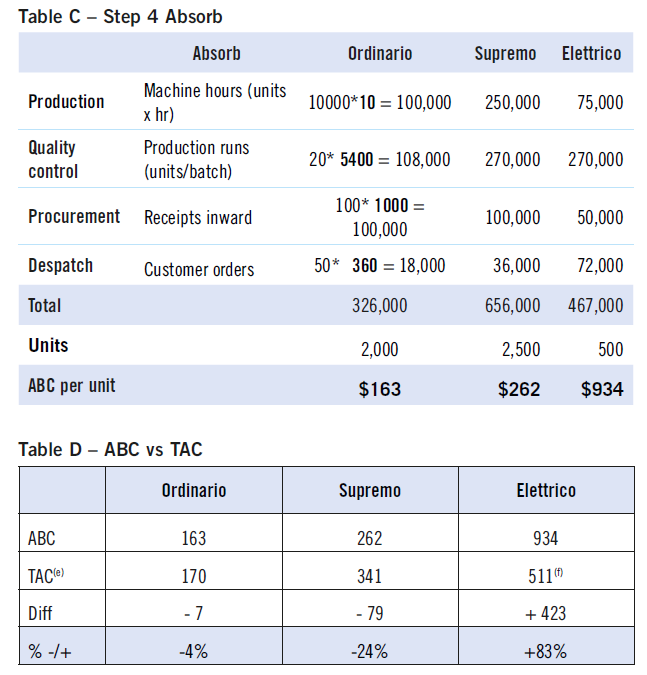

e. Calculated with an OAR based on machine hours only $1,449,000/42,500 = $34.09

f. Elettrico 15 hours x $34.09 = $511

Now we can compare the overhead allocations under ABC versus TAC.

In table D above you can clearly see that the new product, the Electric bike under ABC would be assigned an overhead cost 83% higher than under TAC. This is a significant difference and Lottrechio Bikes would potentially be setting a price for the Elettrico bike far too low if TAC is used.

ABC has many benefits but also drawbacks compared to TAC, and students must know these for the PM exam.

Benefits

1: ABC provides a more accurate method of costing of products and services.

2: It allows for a better and more comprehensive understanding of overheads and what causes them to occur.

3: It makes costly and non-value adding activities more visible, so allowing managers to focus on these areas to reduce or eliminate them.

Drawbacks

1: ABC can be difficult and time consuming to collect the data about activities and cost drivers.

2: It can be costly to implement, run and manage an ABC system.

3: Even in ABC some overhead costs are difficult to assign to products and customers. These costs still have to be arbitrarily applied to products and customers.

ABC is only examined in the OTQ sections of the exam, it is therefore important to be solid in the numerical techniques and the theory behind the techniques, as well as how it compares to TAC.

Geoff: What about ABM here?

As mentioned above, ABM takes the basic information from an ABC calculation and asks if the performance of the business can be improved.

There are various approaches the advanced performance manager can employ.

Consider the cost per driver

Costs per driver have meaning in and of themselves. Does the cost figure seem reasonable or excessive? Could the activity be performed more cheaply (and as well) either internally (with process improvements) or externally (by outsourcing)?

The data above causes raised eyebrows (a very serious thing!) in several areas. For example, quality control appears to be costing $5,400 per production run. Whilst quality is important in this business (people ride on cycles in the road!) one wonders what is being done to warrant such a cost. Perhaps the extent of testing could be reduced? Good quality programmes should invest more in prevention than detection, so improved design or production process approaches should enable a reduction in testing.

Equally the business is spending $1,000 each time a delivery inward is made. This is perhaps less alarming since bicycles are complex things involving many parts, but this may warrant an investigation. In this case considering fewer suppliers might be a way forward to simplify the receipts process.

Outsourcing activities

Quality control could be outsourced. There are firms that will take on this task and Lottrechio could see cost savings as a result.

They would need to be careful to identify the serious faults where no compromise is possible. For example, any fault that makes the riding of the cycle dangerous would be serious and the fullest of attention emphasised to any outsourcer. However, other less serious faults could be downgraded.

Non value-added activities

The general principle is that organisations should remove any activity that is not adding value to the customers (primarily) as this is wasteful. This can extend from the manufacturing process to backoffice activities. For example, if Lottrechio is producing reports in the finance department that no-one reads or understands then that isn’t adding value and should be ceased.

More information would be needed in the above example to identify non-value-added activity within each category of cost. In the APM exam this may well be provided. However, in APM there is also the professional skills aspect. There are marks available for pointing out gaps in the information and explaining why the extra information would be useful. So do that and you will score!

Design Improvements

Lottrechio could look at the design of the various bikes and this could lead to savings in numerous activity areas.

Ford Motor Company, when it bought Saab, asked that the new Saab models use some parts and components from the Mondeo (a Ford car of the time), the idea being that some consistency would save costs. (Allegedly, Saab in the main refused to do that but that is another story.)

For example, slight differences in the handlebars could be challenged and if more consistency followed this could:

• Reduce buy in costs.

• Simplify or quicken production.

• Reduce the variety of good receipts and so reduce the goods inward costs.

Again, in an APM question you would get more background information compared to a PM question to enable such thoughts and analysis.

Summary

ABC focuses on the basic calculations trying to see where we are right now and identify the cost accurately at the moment. PM is thus about counting the beans in this context.

ABM is about making more beans. Can we improve performance? Crucially, ABM can’t do its job without the work of ABC.

Just as a footnote, some very basic ABC calculations can be tested in APM and that is why ABC is covered in my APM course material – so if you’re exempt PM don’t worry, I have got you covered.

• Jo Tuffill is the PM tutor and Geoff Cordwell is the APM tutor at FME Learn Online