Philip Dunn sets you a series of questions relating to measures of shareholders’ interest and risk.

The summarised Financial Statements of Davenport-Dunn Art Supplies Plc for years ended X1 and X2 are shown below.

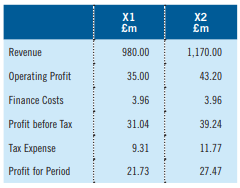

Statement of Profit or Loss

The following Ordinary Dividend had been paid in each year. X1 £4.76m X2 £5.99m

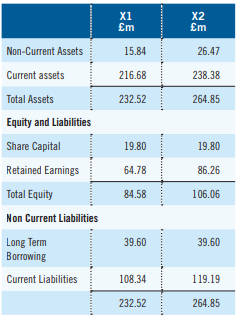

Statement of Financial Position

The nominal value of the issued share capital comprised Ordinary Shares of £0.25 each. Current Market Price per Share: X1 £1.50 X2 £1.75.

Please answer the following MCQ tasks below:

Risk:

1: Calculate Gearing/ Leverage (Debt:Debt+Equity)

| X1 | X2 |

| (a) 46.80% | (a) 37.33% |

| (b) None of these | (b) 27.19% |

| (c) 31.89% | (c) 81.82% |

| (d) 87.26% | (d) None of these |

Shareholders’ Interest:

2: Calculate the Return on Equity/Shareholders

‘Funds.

| X1 | X2 |

| (a) 36.70% | (a) 37.00% |

| (b) 9.34% | (b) 26.90% |

| (c) 25.00% | (c) 25.90% |

| (d) 25.69% | (d) 10.37% |

3: Calculate Earnings per Share

| X1 | X2 |

| (a) 39.19 pence | (a) 49.55 pence |

| (b) 78.38 pence | (b) 34.68 pence |

| (c) 27.44 pence | (c) 99.10 pence |

| (d) 54.87 pence | (d) 69.37 pence |

4: Calculate the Price Earnings Ratio.

| X1 | X2 |

| (a) 3.83 | (a) 3.53 |

| (b) 1.91 | (b) 5.05 |

| (c) 5.47 | (c) 1.76 |

| (d) 2.73 | (d) 2.52 |

5: Calculate the Dividend per Share

| X1 | X2 |

| (a) 5.00 pence | (a) 7.56 pence |

| (b) 6.01 pence | (b) 15.12 pence |

| (c) 12.02 pence | (c) 5.00 pence |

| (d) 10.00 pence | (d) 10.00 pence |

6: Calculate the Dividend Yield

| X1 | X2 |

| (a) 3.33% | (a) 4.32% |

| (b) 4.01% | (b) 8.64% |

| (c) 8.01% | (c) 2.86% |

| (d) 6.67% | (d) 5.71% |

7: Calculate the Dividend Cover

| X1 | X2 |

| (a) 6.52 | (a) 6.55 |

| (b) 7.35 | (b) 4.59 |

| (c) 3.63 | (c) 7.21 |

| (d) 4.57 | (d) 5.77 |

ANSWERS

1: X1 c, X2 b

2: X1 d, X2 c

3: X1 c, X2 b

4: X1 c, X2 b

5: X1 b, X2 a

6: X1 b, X2 a

7: X1 d, X2 b

• Dr Philip E Dunn is a freelance author and technical editor for Kaplan and Osborne Books.