February 2022

What is the suspense account? Karen Groves has the answer!

The suspense account is used as a temporary account if the bookkeeper is unsure about one side of a transaction, or if the Trial Balance doesn’t balance. This applies to both manual and computerised accounting systems.

The suspense account will be used until either the error has been identified, or correct double entry established. It is a holding account until the discrepancies are resolved.

For your Level 2 AAT Bookkeeping Controls assessment, you may be required to open a suspense account and process entries to clear the suspense account.

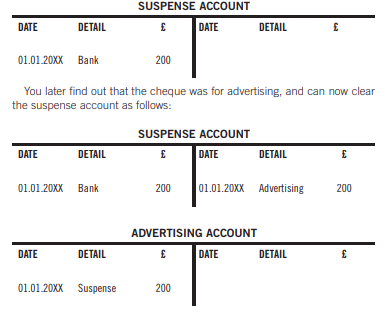

Example

While preparing the company cash book, you find a cheque stub with no details regarding who the cheque for £200 has been paid to. The bank account will be credited with £200, however the debit entry is uncertain at this stage, so a suspense account will be opened:

Example

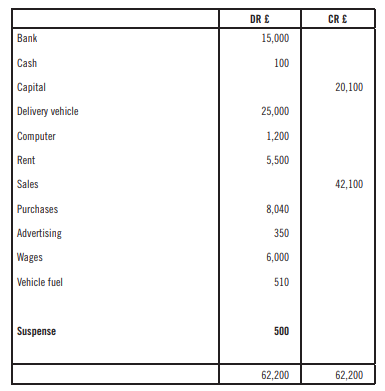

The bookkeeper has prepared a Trial Balance, and the debits and credits do not balance. The errors need to be investigated and corrected.

However, in the meantime, the difference between the debit and credit totals of £500 will be entered as a suspense account balance, to balance the Trial Balance until the errors are identified:

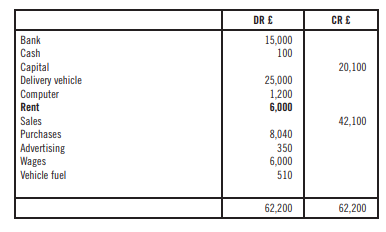

The error has been caused by a payment for rent of £500 being credited from the bank account only, with the debit to the rent account not entered.

The accounts and Trial Balance can be updated to reflect the required adjustment:

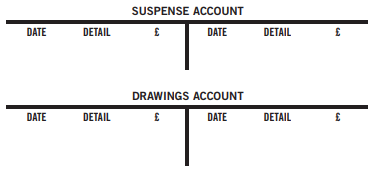

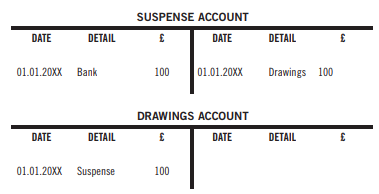

Question

While preparing the company cash book, you find a cash withdrawal with no details regarding who the cash for £100 had been paid to. The bank account will be credited with £100, however the debit entry is uncertain at this stage. You are required to open a suspense account and then show the necessary adjustment when you establish later that day that the £100 was taken by the business owner as drawings.

Today’s date is 1 January 20XX

Answers

• Karen Groves is an AAT tutor and AAT Course Director at e-Careers