April 2024

Karen Groves explains how to approach a typical AAT Level 2 question.

During your studies for AAT Level 2, you may be asked to calculate the overtime premium amount as part of a labour costs question. This can sometimes cause some confusion as students do not know how to approach this task, and incorrectly split the basic and overtime amounts.

Hourly rate employees

The hourly rate is a set amount an employee is paid for each hour worked; however, what happens if they work more hours than the standard number of hours expected for the week?

Overtime refers to the hours an employee has worked above their standard week.

Overtime premium is the amount paid above the employee’s standard hourly rate. If an employee is paid £14 per hour and received ‘time and a half’ for overtime, the amount would be calculated as £14 x 1.5 = £21 per hour. The overtime premium amount will be the £7 extra paid, in addition to the standard hourly rate of £14 classed as the ‘basic’ rate. There needs to be an incentive for an employee to work outside their usual working hours, especially if late at night or over the weekend, hence being paid a higher rate.

It is important to read the question carefully, as you may be asked for the ‘overtime’ or ‘total overtime’ amount, which in the above example would be the £21 per hour. However, if you are asked for the overtime premium amount, then this is the extra bit only, so the £7 in this example.

Let’s look at an example

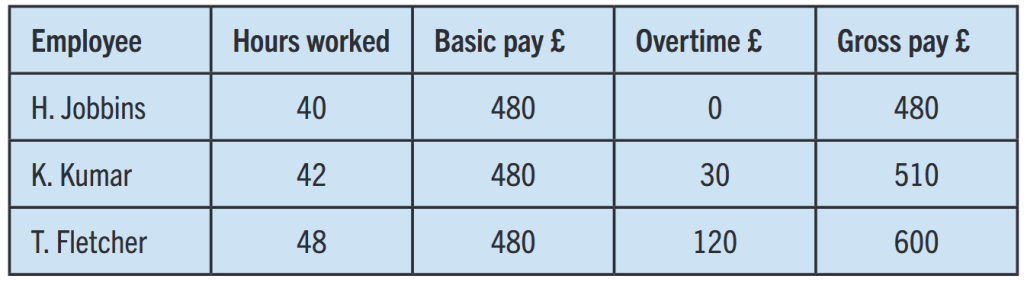

Callie Ltd pays £12 per hour for direct labour for a standard 40-hour week. If the employees work more than 40 hours each week, the overtime is paid at time and a quarter.

Calculate the gross pay for the week for the following three workers:

In the above example, you can see the overtime is based on the hours above the standard 40 hours for the week, so for K. Kumar, 2 hours x £12 x 1.25 = £30 overtime.

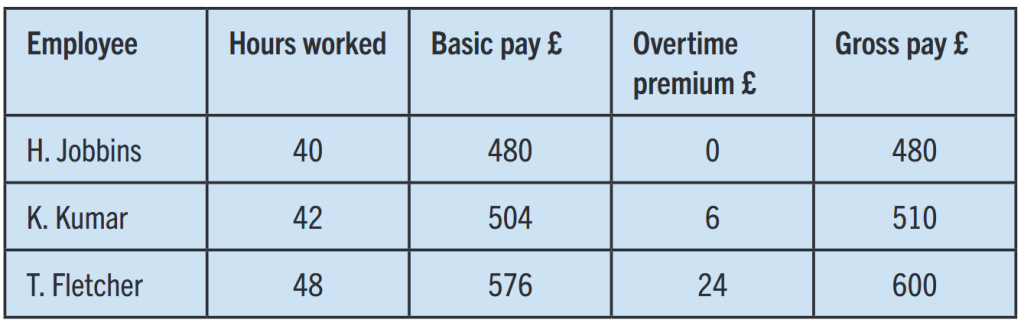

This example is asking for the overtime amount only. We will now look at the same question; however, calculate the overtime premium instead:

Workings:

The overtime premium is based on £12 x 1.25 = £15

£15 – £12 basic pay = £3 overtime premium

H. Jobbins 40 hours x £12 = £480

K. Kumar 42 hours x £12 = £504 plus 2 hours @ £3 = £6. Gross wage £504 + £6 = £510

T. Fletcher 48 hours x £12 = £576 plus 8 hours @ £3 = £24. Gross wage £576 + £24 = £600

Note: The gross pay will be the same regardless of which method you are calculating.

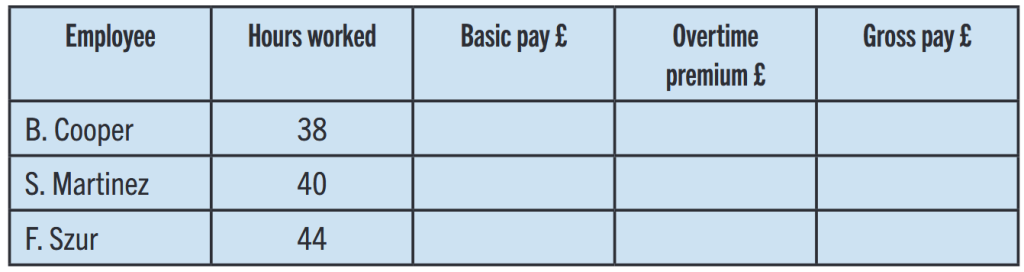

Now have a go!

Lottie Ltd pays £15 per hour for direct labour, for a standard 38-hour week. If the employees work more than 38 hours each week, the overtime is paid at time-and-a-half.

Calculate the gross pay for the week for the following three workers, and show the overtime premium amount (the hours worked are paid at the basic rate with the overtime premium being the increased pay only):

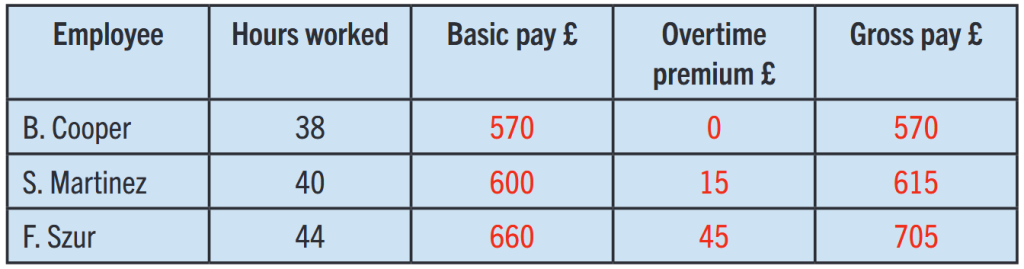

Answers:

Overtime premium = £15 x 0.5 = £7.50 per hour

B. Cooper 38 hours x £15 = £570

S. Martinez 40 hours x £15 = £600 plus 2 hours @ £7.50 = £15. Gross wage £600 + £15 = £615

F. Szur 44 hours x £15 = £660 plus 6 hours @ £7.50 = £45. Gross wage £660 + £45 = £705

- Karen Groves is an AAT tutor and AAT Faculty Director at e-Careers