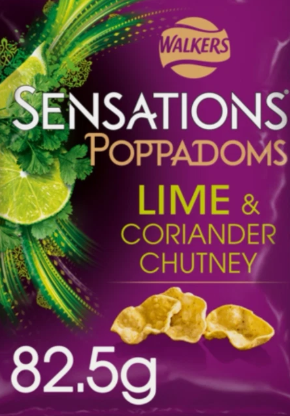

Walkers has lost its appeal against HMRC over its claim that its “Sensations Poppadoms” should be treated as zero-rated for VAT

The First-tier Tribunal had earlier decided that Sensations Poppadoms fell within the excepted item group of “potato crisps, potato sticks, potato puffs, and similar products”, so should be standard-rated for VAT as HMRC claimed.

The appeal judges said although poppadoms are listed on HMRC’s website as a separate product to potato crisps and zero-rated, the reference was to traditional poppadoms served with meals and made from a traditional recipe (gram flour).

Justice Mead and Judge Ashley Greenbank said Walkers calling them poppadoms: “does not affect the question as to whether Sensation Poppdoms should be treated as similar to potato crisps”.

The appeal was duly dismissed.