Philosophers before the 1770s would often talk of the logical paradox of a ‘black swan’. After all, at that time only white swans were known to most of the world. Then, with the discovery of Australia, black swans were found. Today, a ‘black swan event’ (courtesy of Nassim Taleb) is an event that nobody thought was possible.

So, what type of swan did the ugly duckling grow into?

The ACCA Advanced Financial Management exam (AFM, previously P4) has for long been labelled as “the option paper to avoid”. Words like ‘difficult’, ‘challenging’, ‘too hard’, ‘rocket science’ (and even ‘impossible’) have been regularly used to describe the exam (although not by my students!). I would accept that, in the early days, it could be a little tricky, and that was reflected in the pass rates.

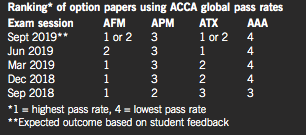

Things have now changed dramatically, especially since being relabelled AFM in September 2018, as the table shows:

As you can see, AFM has had the highest, or second highest, pass rate for the past five sessions – so why is that?

First, the questions are shorter, so students can more easily digest the data provided and not feel overwhelmed.

Second, the AFM syllabus is more contained than others like ATX, and it does not change as regularly. That means that past papers are a clearer guide to the current exam than in some other papers.

Third, the exam guidance is clearer these days. All papers will test, to some extent, Section B (Advanced Investment Appraisal, with or without real options) and Section E (Risk Management).

Section C2 (Business Valuations) is also a common topic. Any candidate knowing these three syllabus areas has a clear advantage.

Advanced Investment Appraisal questions have seen a welcome change recently; a partially prepared solution with the candidate required to complete the calculations. For instance, in one of the questions covering foreign NPV, foreign currency cash flows were given.

The candidate had to convert them into the domestic currency and calculate additional domestic cash flows.

In another question, the ‘base case’ cash flows were provided, and the candidate had to discount them (using Kei) and then move on to the present value of the finance cashflows to find the APV.

Clearly, there is less time pressure when such pro-forma are provided, and more importantly the examiners are testing higher-level skills.

There are currently 17 official AFM articles available via the ACCA website. I was privileged to write four of these and have input into one other. They are a nice mix between providing knowledge (eg Islamic Finance) and demonstrating how to answer particular types of exam questions (eg Business Valuations).

These articles are invaluable, and are regularly tested in the exams. So the message is clear: know your AFM articles!

Under the old P4 paper candidates were required to choose 2 from 3 questions in Section B. The current AFM exam has removed this choice, and paradoxically this has led to improved pass rates. An optional exam element appeared to waste candidates’ time, and perhaps led to greater ‘question spotting’ than was wise. Knowing you have to attempt all parts of each of the three questions set makes matters simpler, and discourages a focus on a narrow subset of the syllabus.

P4, and its predecessors, could lay claim to being ‘the ugly duckling’ of the ACCA professional stage, with the reputation to match. Now it’s all grown up my view is AFM is a ‘black swan event’ – a beautiful paper with a decent pass rate that rewards the well-placed efforts of ACCA students, and one that deals with a fascinating subject area. The ugly duckling is indeed now a thing of beauty.

• Sunil Bhandari is an ACCA AFM and FM tutor with FME Learn Online