March 2022

Karen Groves explains this important concept and tests your knowledge with a question about it.

As part of your AAT studies, you will need an understanding regarding how to account for inventory, which can include both raw materials and goods that are held for resale. Inventory is a current asset and must be included in the financial statements to reflect this.

IAS 2 Inventory states that we should recognise inventory at ‘the lower of cost and net realisable value’. The cost includes the purchase cost, costs to bring the inventory to its present location and any conversion costs. The net realisable value (NRV) is the estimated or actual selling price minus any costs to sell, for example selling and distributing.

At the end of an accounting period, the inventory is counted and valued.

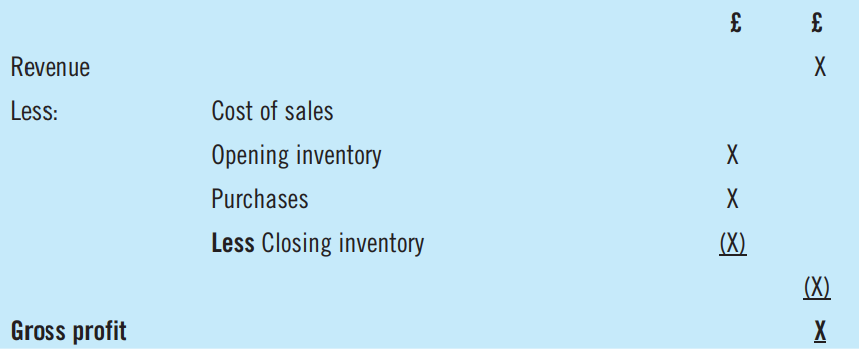

Inventory is shown in both the Statement of Profit or Loss (SPL) and Statement of Financial Position (SFP).

Let’s look at the Statement of Profit or Loss:

The cost of sales includes the opening inventory (this would be the previous year’s closing inventory), plus purchases, minus closing inventory.

The closing inventory is deducted as this inventory will be carried forwards into the next accounting period.

The closing inventory will also be entered in the Statement of Financial Position, as a current asset.

The double-entry to account for the closing inventory would be:

Debit – Closing Inventory (SFP)

Credit – Closing Inventory (SPL)

Example

EC manufacture shirts. The following information has been provided:

Cost per shirt £8

Selling price per shirt £2

Selling price £15

The value for each shirt in inventory would be as follows:

£

Cost 8

Net realisable value (£15 – £2) 13

Each shirt in inventory would therefore be valued at £8, being the lower of cost and NRV.

Usually, the inventory will sell for a profit, so the NRV will be higher than cost. If inventory was valued at the NRV, this would include a profit element which is not allowed under IAS2.

Occasionally, a loss could occur if the NRV was lower than the cost and, in this situation, the NRV amount would be used as the inventory valuation.

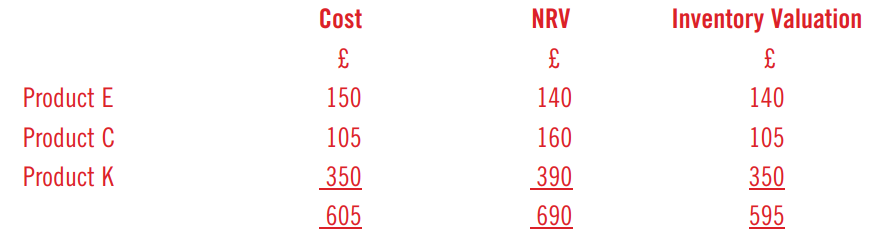

IAS2 also states that each inventory line should be valued separately, and not merged.

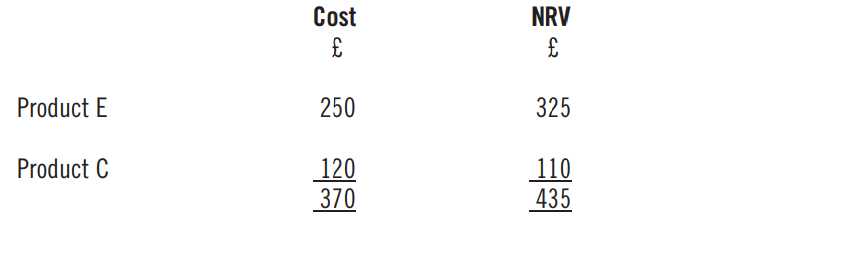

Example

There are two lines of inventory for company A. The details of the cost and NRV are as follows:

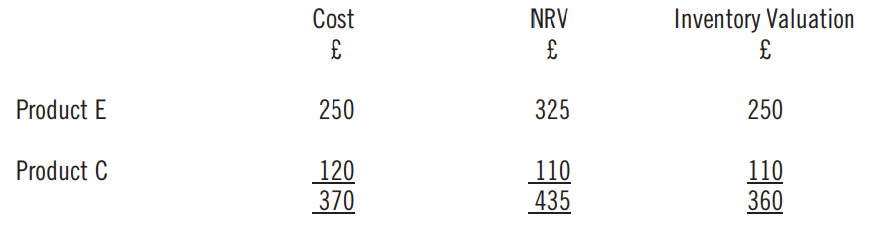

Solution

Product C has a lower NRV than cost, so this must be used for the valuation.

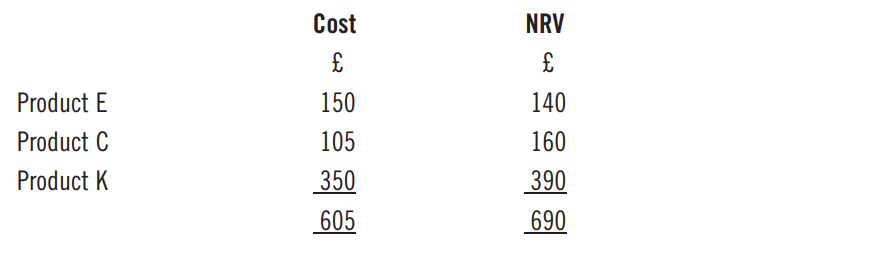

Question

There are three lines of inventory for company B. The details of the cost and NRV are as follows:

Solution

• Karen Groves is an AAT tutor and AAT Course Director at e-Careers