March 2022

Professor Philip E Dunn tests your knowledge of Consolidated Financial Statements.

Q1. Which International Financial Reporting Standard deals with a Business Combination?

Q2. Which International Financial Reporting Standard deals with Consolidated Financial Statements?

Q3. Positive Goodwill is capitalised but is then subject to what on an annual basis?

Mini case study

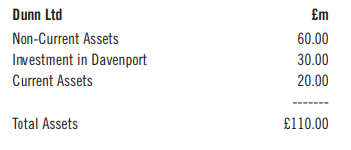

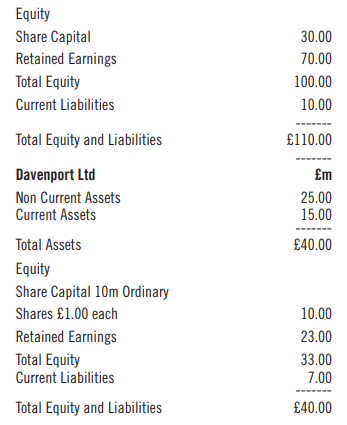

Dunn Ltd acquired 7.5m shares in Davenport Ltd at a cost of £30m on 1 January 2020 and the summary Statements of Financial Position of the companies immediately after the acquisition were:

Q4. Calculate the amount of Goodwill arising on the acquisition.

Q5. Calculate the Non-Controlling Interest. When drafting the Consolidated Statement of Financial Position immediately after the acquisition what would be the values for the following?

Q6. Non-Current Assets.

Q7. Goodwill.

Q8. Current assets.

Q9. Total assets.

Q10. Share capital.

Q11. Retained earnings.

Q12.

Non-Controlling Interest.

Q13. Total equity.

Q14. Current liabilities.

Q15. Total equity and liabilities.

Q16. In future years the Goodwill will be subject to Impairment under which International Financial Reporting Standard?

Answers

Q1. IFRS 3 Business Combinations

Q2. IFRS 10 Consolidated Financial Statements

Q3. Impairment

Q4. £5.25m

Q5. £8.25m

Q6. £85m

Q7. £5.25m

Q8. £35m

Q9. £125.25m

Q10. £30m

Q11. £70m

Q12. £8.25m

Q13. £108.25m

Q14. £17m

Q15. £125.25

Q16. IAS 36 Impairment of Assets