September 2020

Rabia Rehman explains how value added tax works – and it’s probably a bit more complicated

than you think it is…

Value added tax (VAT) was introduced in the UK in 1973. It is the third-largest source of government revenue, after income tax and National Insurance, and is administered and collected by HM Revenue and Customs.

VAT registration

Businesses with a turnover of more than £85,000 must register to pay and charge VAT on the products and services they buy and sell. Other businesses can choose to register for VAT voluntarily.

When you register, you’ll be sent a VAT registration certificate. This confirms:

• Your VAT number.

• When to submit your first VAT Return and payment.

• Your ‘effective date of registration’ – this depends on the date you went over the threshold, or is the date you asked to register if it was voluntary.

You can register voluntarily if your turnover is less than £85,000, unless everything you sell is exempt. You’ll have certain responsibilities if you register for VAT.

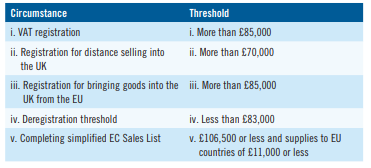

VAT threshold

The thresholds for registering for VAT or joining a VAT accounting scheme from 1 April 2017:

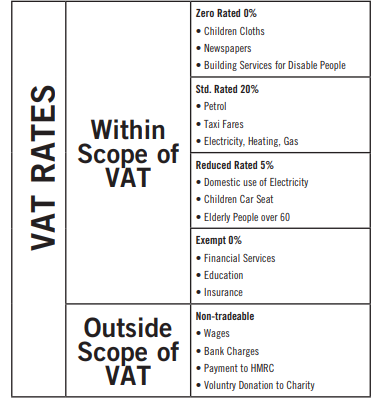

VAT rate

VAT is levied on most goods and services provided by registered businesses in the UK and some goods and services imported from outside the European Union. The rates are:

• Standard rated – 20%

• Reduced rated – 5%

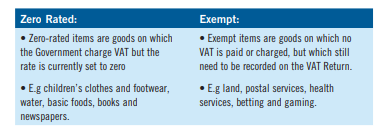

• Zero rated – 0%

• Exempt – 0%

• Outside scope of VAT

Difference between exempt and zero rated

Outside scope of VAT

If something is outside the scope of VAT it means that VAT doesn’t apply at all. If you sell these goods and services, you won’t charge any VAT. If you buy them, there won’t be any VAT to reclaim.

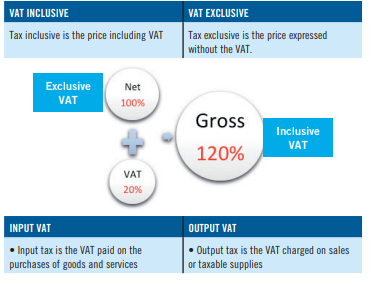

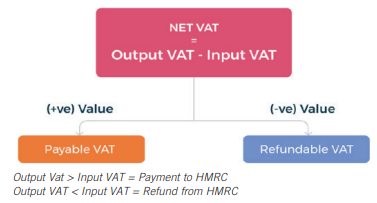

VAT is payable or reclaimable

VAT rates for EU

The European Union’s VAT system is based on the destination principle. This means that VAT (only) must be paid to the government of the country in which the consumer who buys the goods lives.

According to EU law, EU Member States are required to levy a standard VAT rate of at least 15% and a reduced rate of at least 5%. When a zero rate is applied no VAT has to be paid by the consumer but you still have the right to deduct the VAT you have paid on purchases directly (Europa.eu).

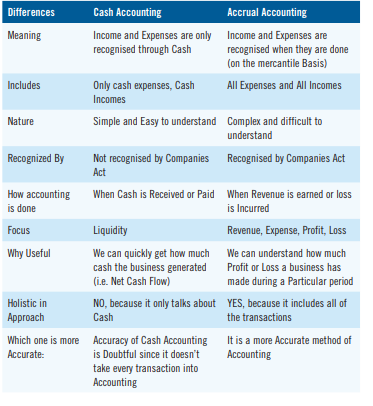

What is the Cash Accounting Scheme?

The Cash Accounting VAT Scheme is a method of reporting VAT on the basis of payments made or received. Usually, the amount of VAT you pay HMRC is the difference between your sales invoices and purchase invoices.

With the Cash Accounting Scheme you:

i. pay VAT on your sales when your customers pay you

ii. reclaim VAT on your purchases when you have paid your supplier

How to join

• You must be eligible to join the scheme.

• You join at the beginning of a VAT accounting period.

• You don’t have to tell HM Revenue and Customs (HMRC) you use cash accounting. (Gov.uk)

How to leave

• You can leave the scheme at any time.

• You must leave if you’re no longer eligible to use it, leave at the end of a VAT accounting period.

• You must report and pay HMRC any outstanding VAT (whether your customers have paid you or not).

• You can report and pay the outstanding VAT over 6 months.

• If your VAT taxable turnover exceeded £1.35 million in the last three months you must report and pay straight away.

• You must pay immediately if HMRC has written to you to withdraw your use of the scheme.

Eligibility

You can use cash accounting if your business is registered for VAT and your estimated VAT taxable turnover is £1.35 million or less in the next 12 months.

You must leave the scheme if your VAT taxable turnover is more than £1.6m.

Exceptions

You can’t use cash accounting if:

• You use the VAT Flat Rate Scheme – instead, the Flat Rate Scheme has its own cash-based turnover method.

• You’re not up-to-date with your VAT Returns or payments.

• You’ve committed a VAT offence in the last 12 months, for example VAT evasion.

You can’t use it for the following transactions; use the standard scheme instead:

• Where the payment terms of a VAT invoice are six months or more.

• Where a VAT invoice is raised in advance.

• Buying or selling goods using lease purchase, hire purchase, conditional sale or credit sale.

• Importing goods from within the EU.

• Moving goods outside a customs warehouse.

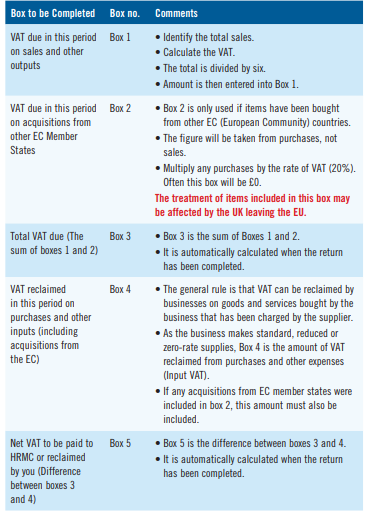

VAT returns

Difference between Accrual and Cash Accounting Scheme

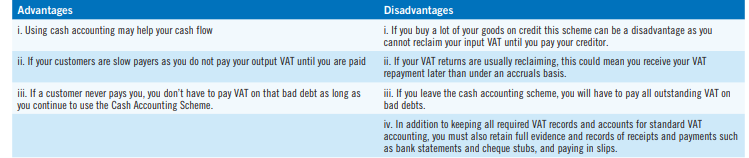

Pros and cons