March 2023

Karen Groves explains how to approach a bank reconciliation exam style question and tests your knowledge on the subject.

As part of your AAT Level 2 and 3 studies, you will need to be confident in tackling a bank reconciliation question.

A bank reconciliation is completed at regular intervals, usually once a month. It is a reconciliation to determine any differences between the cash book and bank statement. There are likely to be items on the bank statement that are not in the cash book, for example, if a customer pays by BACS and doesn’t send a remittance advice, the first time you will notice the receipt is looking at the bank statement. Bank charges are another item often not recorded in the cash book.

Why are there items in the cash book that are not on the bank statement you may wonder? This is all down to timing differences. For example, if I write a cheque and put it in the post today, there will be the delay whilst it is delivered, and then a further delay until the cheque is actually banked.

The main areas of confusion are around prior period reconciling items. These are items that are written out in the previous month and are reconciling items during that month (think about your unpresented cheques or uncleared lodgements). All too often, students are focussed on the current month only, however, consideration needs to be given for what happened during the previous month.

Our first task should be identifying any prior period reconciling items, match these, and then move to ticking off the other items between cash book and bank statement.

Any items left unticked on the bank statement need to be entered in the cash book and any items unticked in the cash book will form the bank reconciliation as we are about to see.

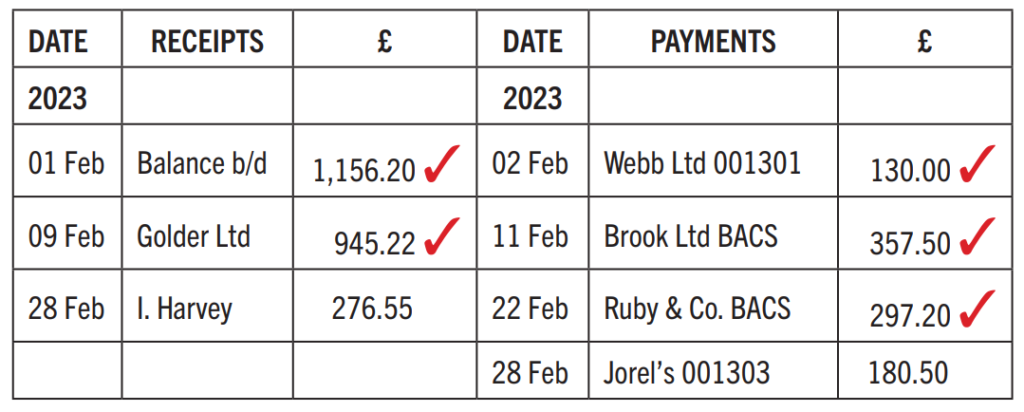

Example

The cash book for February needs to be reconciled with the bank statement.

The first thing we need to do is to compare the opening cash book and bank statement balances. You will see that there is a difference of £150 (£1,306.20 – £1,156.20), showing the bank statement balance is £150 higher than the cash book. You can see on the bank statement a cheque numbered 001300 for £150. This is a prior period reconciling item which can be confirmed by the cheque number, as we start with 001301 in this month’s cash book. We will mark this as matched and then continue ticking off the other items between the cash book and bank statement.

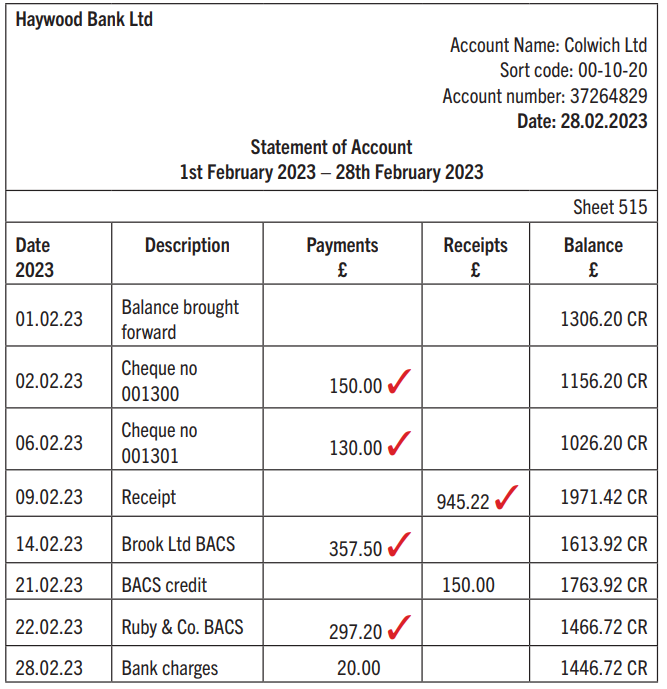

Bank Statement

Next, we can update the cash book for any items that need to be entered. You will see two amounts on the bank statement, one BACS receipt for £150 and a bank charges payment for £20 that are not ticked and must now be entered:

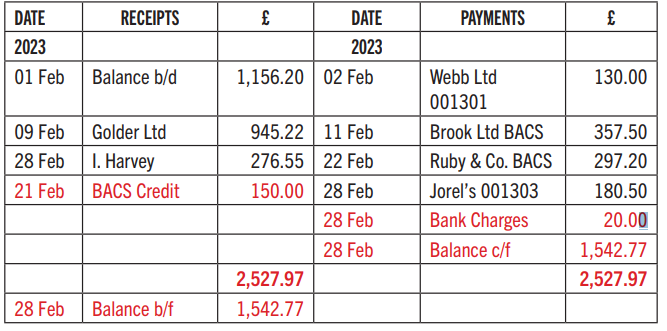

Solution

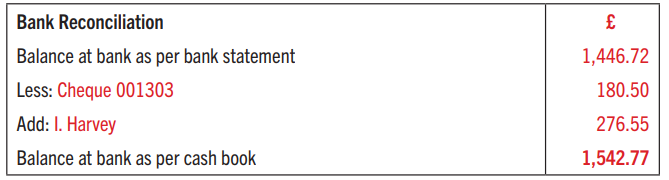

We finally prepare a bank reconciliation. There are two items in the cash book that are not ticked, an uncleared lodgement for £276.55 and an unpresented cheque for £180.50.

Solution

The bank reconciliation is now complete, and the balance agrees as per the cash book.

Now you have read this example, have a go at a bank reconciliation question in your own study resources, watching out for any prior period items!

• Karen Groves is an AAT tutor and Faculty Director of Accounting at e-Careers