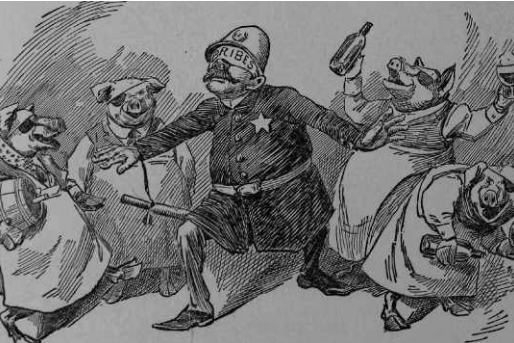

December 9 was International Anti-Corruption Day, an annual event created in 2003 when the United Nation’s (UN) General Assembly adopted the UN’s Nations Convention against corruption. Kicking off in December 2005, this occasion is a chance to stop and think about why anti-corruption matters, and the part the accountancy profession plays in tackling bribery and corruption.

Some 14 years later it is, of course, still the case that corruption blights business, societies and individuals. Due to media headlines and social media we are more aware than ever of bribery and corruption and the damage it causes.

Transparency International defines corruption as “the abuse of entrusted power for private gain”. They publish global research and resources on bribery and corruption, including how it affects the public sector, business, and even individuals. They also look at how specific sectors are affected by such abuses of power – from sport to politics to education.

Not immune from corruption

There are many reasons and motivations why corruption happens, from personal financial gain to securing power. And because money is often at the heart of such activities, experts like accountants are not immune from becoming involved in bribery and corruption – sometimes unwittingly and, unfortunately, sometimes willingly.

Accountants are often the first to see the signs of bribery and corruption. The accounts may look wrong; board decisions and corporate governance may swerve the rules; you hear rumours about backhanders being offered. The activities linked to bribery and corruption are myriad, and it can be a minefield for the finance professional to navigate.

The judgement an accountant possesses is crucial. Our ability to stop and really think ‘is this right?’ matters more than ever, especially in the digital age. And as a profession, we also need to realise that bribery and corruption is not something that just happens in big business.

Indeed, SMEs are just as open to bribery and corruption as larger corporations. Our latest report, entitled ‘Combating bribery in the SME sector – UK analysis’, surveyed hundreds of UK accountancy experts, updating research from 2013.

Among the 2019 respondents, 66% do not think there is enough guidance for SMEs, up from 49% in 2013. And 16% do not know, suggesting they may not be aware of the guidance that does currently exist from various sources such as government and regulators.

A particular concern SMEs raised were the challenges they face in understanding the legal requirements in connection with bribery and corruption, pinpointing perceived additional costs from compliance with the UK legislation, with conclusive findings that show businesses are desperately searching for that much-needed support to understand the legal requirements of areas such as the Bribery Act 2010.

This is where professional advice and support from accountants and lawyers comes into play; and indeed respondents recognised this fact with the majority – 30% for each – saying this would be the case.

At a time when businesses in the UK face international trade uncertainty, SMEs also expressed fears about the risk of losing business when trading abroad due to a loss of parity with larger firms.

So our survey shows that bribery and corruption remains a legitimate concern for SMEs, including the loss of a ‘level playing field’ when competing for business, the increased costs that can result, and the risk of losing business if refusing, for example, to make facilitation payments. Many perceive it as a particular risk when trading abroad.

Our commitment as a professional body is to train accountants with the skills and competencies to help them spot bribery and corruption and understand the related legalities. Our corporate and business law syllabus covers this, with a focus on the Bribery Act 2010, the Criminal Finances Act 2017 and recent money laundering regulations. And when qualified, we also offer updates and CPD that aim to keep our members aware of developments.

The challenge for any individual is to understand how to report and stop bribery and corruption. This is a big responsibility and – thankfully – in my career I’ve not had to call out instances of bribery and corruption. I’ve been lucky to work for organisations that have clear policies and guidelines about such issues, about what is acceptable and what is not. Some accountancy practices may wish to consider developing greater expertise in this area in order to be able to provide appropriate support and services to their SME clients. By doing so they could further develop their role as trusted business advisers.

While the risk of bribery and corruption is still with us, there is a huge professional responsibility on accountants to be aware of the signs and act upon them. But the profession cannot do this alone – it takes many players on the global stage, from the UN to the SME on the local high street, to tackle bribery and corruption.

• Maggie McGhee is ACCA’s executive director – governance