January 2023

The IFA looks at the benefits of thinking small when it comes to your career.

With 14% of annual graduate vacancies in the UK coming from the Big 4 – PwC, Ernst & Young, KPMG and Deloitte – there is a perception, or perhaps an expectation, that these vacancies will be within easy reach and are the natural first step in your career.

Yet this is not representative of the full graduate landscape. The Big 4 account for a combined 1,200-2,000 UK graduate vacancies per year while there are 160,000 UK accountancy students and 580,000 worldwide.

The majority of qualified or part-qualified accountants will find their future in the SME sector, working in one of the nearly 4.9 million SME businesses in the UK, which between them employ more than 14 million people.

Don’t overlook the potential of SME employment, says the Institute of Financial Accountants (IFA), part of a group representing some 49,000 SME accountants and firms worldwide.

“SMEs have a lot to offer,” said Jonathan Barber, Director, Business Development and Membership at the IFA. “Every year, we support several thousand new graduates starting out in SME businesses and the benefits they quote are far-reaching. Variety is one key aspect, with graduates extolling the value of SMEs in delivering a multi-faceted working environment allowing them to put into practise an extensive range of their acquired skills. Training and development is another, with SME businesses offering both internal training in practical skills, but also onward progression opportunities. “Perhaps the biggest benefit is the level of trust placed in you within an SME role.

The majority of SME businesses already cite their accountant as their single most trusted business adviser. Working within an SME provides scope to make very direct, very real and very beneficial recommendations to businesses that have the control and dedication to implement them.”

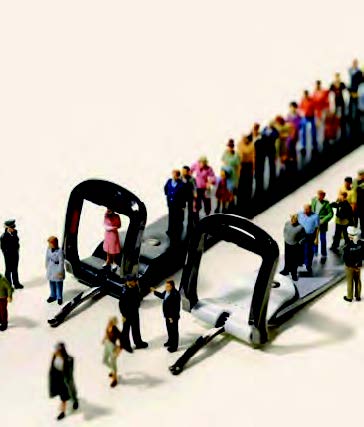

Other benefits recent graduates mention include: innovation, with SMEs more agile and able to respond flexibly to market changes; better work-life balance; an enjoyable workplace culture; and opportunities for promotion. The question, therefore, is how to gain one of these coveted roles, and how to stand out from the crowd in a pool of fellow graduates.

Barber said: “In our experience, it comes back to relationships. Students can choose to network with local businesses, but often overlook the value in this until they are seeking employment. The IFA runs regional networking meetings which bring together like-minded individuals. They are free to attend and open to non-members. The students that attend proactively put themselves in the shop window, with growing numbers undertaking internships with a possible future employer while completing their university course.”

• Thanks to the Institute of Financial Accountants (IFA) for this article. Go to www.ifa.org.uk