April 2022

Jo Tuffill explains the importance of understanding cost behaviours Meet Clara, the founder of Clara Candles Co. Clara’s candles are very on trend for the millennials, who want urban themed candles at an inexpensive price.

Clara has been selling online direct to the public through her website linked to her Instagram and Facebook accounts. She has a problem though. She wants to know if she is selling at the right price to make a profit? She wants your help.

Some theory

‘Cost’ means any expense a business incurs while producing goods or services. There are two main cost types; variable and fixed.

Variable costs are any expenses that change based on how much a company produces. So variable costs increase as production output rises and decrease as production output falls.

Labour and raw materials are usually variable costs. Calculating total variable costs can be done by multiplying the quantity of output by the variable cost per unit of output.

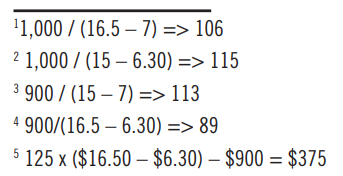

For example, Clara Co produces scented candles for a variable cost of $7 per candle. If Clara Co doesn’t produce any candles it won’t have any variable costs. If Clara Co produces 50 candles its total variable cost will be $350. And if Clara Co produces 100 candles its total variable cost will rise to $700.

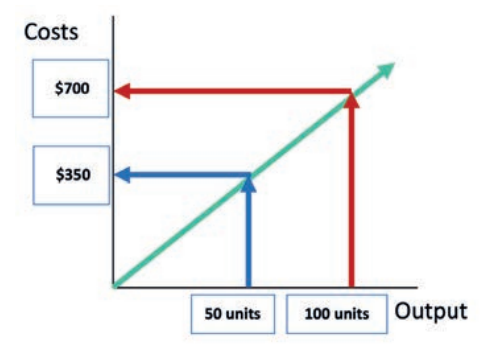

Fixed costs are any expenses that remain the same no matter how much a company produces. These costs are independent of a company’s business activities and might include things like rent, insurance, and depreciation.

Fixed costs remain the same regardless of whether goods or services are produced or not, so a company cannot avoid fixed costs.

For example, assume Clara Co pays rent on its production premises of $1,000 per month. If Clara Co does not produce any candles for the month, it still needs to pay $1,000. But even if it produces 1,000 candles a month, its fixed cost remains the same.

Applying this theory

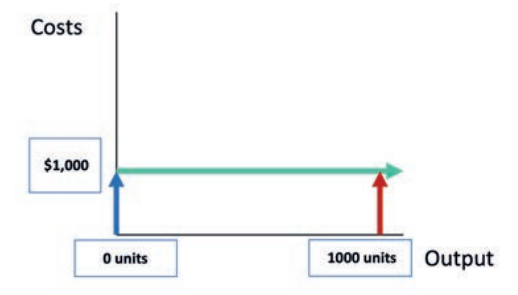

So how many candles must Clara produce in a month to cover her fixed costs? We call this Clara’s breakeven point, and the process of finding this we call ‘Breakeven analysis’.

Clara sells the candles for $15 and incurs a variable cost of $7 per candle, so she makes $8 every time she sells a candle. In management accounting, this is called ‘contribution’. When Clara sells a candle, she is ‘contributing’ towards paying her fixed costs of $1,000 a month. Once she has sold enough to cover her fixed costs, she will start to make a profit. This point is called the breakeven point.

Using our understanding of cost behaviours, we can plot Clara’s revenue and costs against output in a ‘breakeven chart’. The point at which the revenue equals the total costs (variable plus fixed costs) is the breakeven point. Clara’s breakeven point is at 125 candles per month.

We can calculate this by dividing the fixed costs of $1,000 by the contribution per unit of $8. As we cannot sell part of a candle, we always round up to a whole number of candles.

Advising Clara

If you sell 125 candles a month you will cover your costs. If you sell more you will make a profit. If you think that’s not achievable then you have three options:

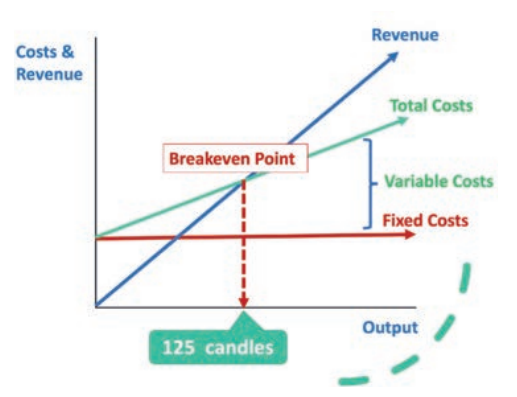

Raise your price: for example, a price rise of 10% to $16.50 now means you have to sell 19 fewer candles a month to breakeven at 106 candles.1

Reduce the variable cost per unit: a reduction of 10% to $6.30 now means you have to sell 10 fewer candles a month to breakeven at 115 candles.2

Reduce your fixed costs per month: a reduction of 10% to $900 a month, means you sell 12 fewer candles a month to breakeven at approx. 113 candles.3

A combination of all three means you would reduce your breakeven point to 89 candles4.

And with this new price and cost structure, if you now sell 125 candles you will make a profit of $375 per month5.

An understanding of a business’ cost structure is fundamental to its success. That’s why it is one of the first concepts taught in management accounting.

• Jo Tuffill is an ACCA online tutor at FME Learn Online

To check out Jo’s Back to Basics cost behaviour video go to: https://vimeo.com/680501310