April 2022

Karen Groves explains how to approach a payroll exam-style question and tests your knowledge on the subject.

The payroll department staff are responsible for correctly calculating the amount of pay to each employee and ensuring the employees are paid on time. After all, as employees, we want to be paid on time and receive the correct amount!

The gross pay is the total amount earned by the employee and can comprise of basic pay plus other elements such as:

• Overtime pay.

• Bonuses.

• Commission.

• Holiday or sick pay.

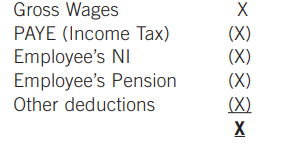

Employees rarely take home their gross pay as the government requires the employer to make certain deductions from gross pay before it is given to the employee. Income tax and national insurance contributions are the main statutory (compulsory) deductions and any student loan repayments.

The net pay (take home pay for the employee) will include:

Income tax is a tax on an individual’s income, and the rate depends on the amount of their income. All employees are entitled to some taxfree income, which is known as the personal allowance. This is the amount that an employee can earn before paying tax.

National insurance is a scheme which pays towards benefits including jobseeker’s allowance, retirement pensions and maternity allowance. Most employees who earn above a certain level must pay national insurance contributions.

In addition to income tax and national insurance contributions, the employee can ask the company to make deductions from gross pay, for example for a pension scheme, to contribute to charity (payroll giving) or union subscriptions.

The statutory and voluntary deductions reduce the take-home pay of the employee.

The deductions are withheld by the employer and forwarded to the appropriate external agency when due. For example, income tax and national insurance contributions are forwarded to HM Revenue & Customs. Until the deductions are sent, they are liabilities that reflect what the business owes.

Employers are also required to pay employer’s national insurance contributions and often contribute towards the employee’s pension.

The total cost (expense) to the employer of employing a member of staff includes the gross pay plus the employer’s contributions.

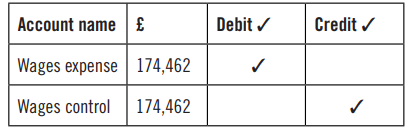

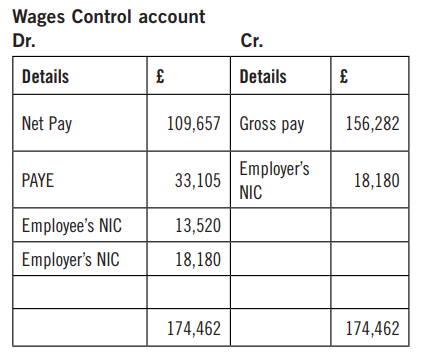

The payroll staff will enter the payroll costs into the bookkeeping system. A Wages Control Account will be used, which is a double entry account. The cash book will be used to show the net payment of wages; however, the entries are first listed in the journal. The Wages Control

Account is a control account through which all the postings relating to wages are made. Once all the amounts have been posted, the balance on this account will be zero.

Example

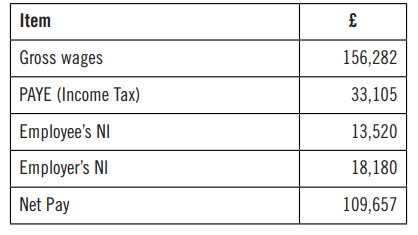

Below is a summary of the totals of the wages book for the month of April 2022.

The journal entries needed in the general ledger are as follows:

Wages expense to include:

• Gross wages plus

• Employer’s NI

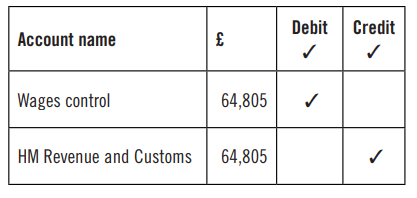

HM Revenue and Customs liability to include:

• PAYE (Income Tax) plus

• Employee’s National Insurance plus

• Employer’s National Insurance

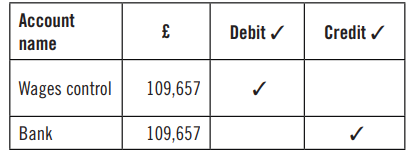

Net wages paid to the employees includes:

• Gross pay minus PAYE (Income Tax) and Employee’s National Insurance

Question

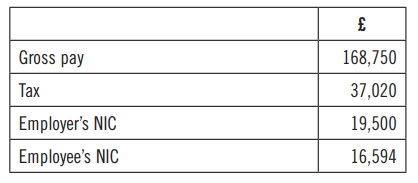

This is a summary of EC Ltd’s payroll for April 2022:

What is the total wages expense for the month?

Answer = £168,750 + £19,500 = £188,250

What is the amount owing to HM Revenue & Customs for the month of April?

Answer = £37,020 + £19,500 + £16,594 = £73,114

• Karen Groves is AAT course director at e-Careers