July 2020

This introduction to this technique will be of interest to Level 3 students and those on the Accounting Apprenticeship Programme – Assistant Accountant, says Philip Dunn.

Trainee accountants, accounting technicians and certified

bookkeepers prepare management information on a regular basis

in the form of management accounting reports, and have in their

financial vocabulary an array of terminology that is included in such reports to aid their relevance to managers.

Break-even analysis is a management accounting technique that relies

heavily on the concept of marginal costing that classifies cost as either

fixed or variable in a range of decision-making aids to management.

The terminology embedded in break-even analysis includes:

• Variable cost.

• Fixed cost.

• Contribution (sales revenue less variable costs).

• Break-even point.

• Margin of safety.

Definitions

• Variable cost: one which will increase or decrease in line with the

volume of output.

• Fixed cost: one which will remain constant irrespective of the volume of output.

• Contribution: the excess of sales (revenue) over variable cost. This may be expressed in total and or per unit of output.

• Break-even point: that point at which total contribution is equal to total fixed costs and neither a profit nor loss is made.

It is expressed in units as:

Fixed costs/contribution per unit

Or in ‘£’ value of sales as:

Fixed costs/ (contribution/sales)

NB: Contribution/sales is referred to as the profit volume ratio.

• Margin of safety: This can be expressed in terms of sales revenue or

number of units. It is the excess of sales revenue over the break-even

point in sales revenue or the excess of units of output over those at the

point of break-even and is usually expressed as a percentage.

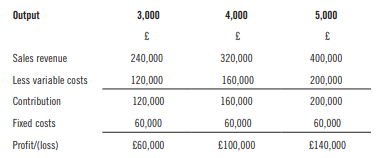

Mini case study:

Dunn Strike is an SME and manufactures a high-quality cricket ball.

The flexible budget for three months ended March 2020 showed:

A question often asked by management is at what level does the business break-even?

From the flexible budget report we can determine the volume of output

at which the business breaks even and calculate the margin of safety at

an output of 5,000 units that being the target output for the quarter set by management.

Contribution per unit of output:

| £ | |

| Selling Price | 80 |

| Variable Costs | 40 |

| Contribution per unit | 40 |

• Break-even point in units

Fixed costs/Contribution per unit

£60,000/£40 = 1,500 units or 30% of output

• Break-even in sales revenue

Fixed costs/ (Contribution/sales)

£60,000/ (£200,000/£400,000)

£120,000 (1,500 x £80)

• Margin of safety

5,000 units less 1,500 units = 3,500 units or 70% of output

Sales revenue £400,000 less £120,000 = £280,000 (3,500 x £80)

The above calculations of the margin of safety are expressed in both

units and sales revenue.

The table below shows the margin of safety at the varying levels of output:

| Output units | 3,000 | 4,000 | 5,000 |

| Break-even point (units) | 1,500 | 1,500 | 1,500 |

| % of output at break-even | 50% | 37.5% | 30% |

| Margin of safety (units) | 1,500 | 2,500 | 3,500 |

| % Margin of safety | 50% | 62.5% | 70% |

Conclusion

The business has a relatively low level of break-even (30%) of output

based on a budget of 5,000 units and thus has a high margin of safety and if this can be achieved it would yield a net profit to sales ratio of 35%.

Such information is vital to management in the control of resources and is of particular relevance in periods of downturn in the volume of business as with the current situation on a global scale. The management need to know at what capacity the business would break-even or what the losses would be at volumes of output below the break-even point.