June 2022

Teresa Clarke explains a concept that students studying Level 2 Elements of Costing or Level 3

Management Accounting: Costing really need to know about Flexing budgets can be confusing, so I will explain this using the ingredients for a cake. I have budgeted the following ingredients to make one cake.

125g flour

125g sugar

125g butter

2 (100g) eggs

I have budgeted to make and sell 100 cakes. I multiply the ingredients per cake by 100 to find out the total ingredients needed to make 100 cakes.

Budget – 100 cakes

Flour 125g x 100 = 12,500g

Sugar 125g x 100 = 12,500g

Butter 125g x 100 = 12,500g

Eggs 100g x 100 = 10,000g

I have actually baked and sold 120 cakes and used the following ingredients:

Actual – 120 cakes

Flour 16,000g

Sugar 14,500g

Butter 15,000g

Eggs 11,900g

I need to know whether I have gone over or under budget with the amount of ingredients I have used on these cakes? I can’t simply compare what I have used with the budget, because the budget was for only 100 cakes, and I made 120 cakes. I need to flex or adjust the budget to match the actual.

To do this I find the unit cost of each first, then multiply by the actual cakes baked and sold.

Budgeted flour: 12,500g divided by 100 equals 125g per cake, then multiplied by 120 cakes = 15,000g

Budgeted sugar: 12,500g divided by 100 equals 125g per cake, then multiplied by 120 cakes = 15,000g

Budgeted butter: 12,500g divided by 100 equals 125g per cake, then multiplied by 120 cakes = 15,000g

Budgeted eggs: 10,000g divided by 100 = 100g per cake, then multiplied by 120 cakes = £12,500g

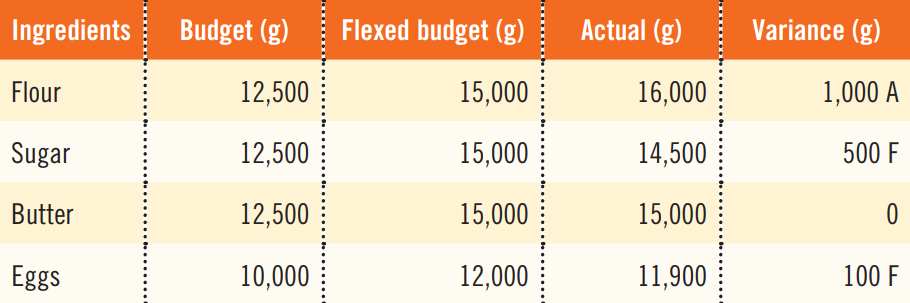

I complete the table below with the flexed budget figures and compare the new budget for 120 cakes against the actual figures for 120 cakes to find any variance on the ingredients used. If I have used more than the budget, then this is adverse. If I have used less than the budget, then this is favourable.

I hope my cake description has helped you understand flexed budgets and not made you too hungry. You can use this same approach with flexed budgets in your studies.

If you would like more tips and guidance, you might like my workbooks, available from Amazon in paperback and as eBooks. Links can be found here at https://www.teresaclarke.co.uk/books/

• Teresa Clarke FMAAT is an AAT tutor