June 2022

Karen Groves explains how to approach a disposal of capital assets exam style question and tests your knowledge on the subject.

Disposal of capital assets is first assessed at AAT Level 3 within the Advanced Bookkeeping unit. When a business disposes of a capital asset, the asset must be removed from the accounting records. The asset is usually disposed of for more or less than the carrying amount, as the carrying amount is an estimate based on how long the business considers the useful economic life of the asset to be. The carrying amount is calculated as the cost of the asset minus accumulated depreciation.

The disposal must be recorded in the non-current asset register, to ensure this is up to date, together with updating the non-current asset cost account and accumulated depreciation account. A disposal account is used to remove the balances and determine the profit or loss on asset disposal.

If the capital asset is disposed of for more than the carrying amount then a profit on disposal is made, however if the capital asset is disposed of for less than the carrying amount, a loss is made.

The following steps should be taken to remove the non-current asset:

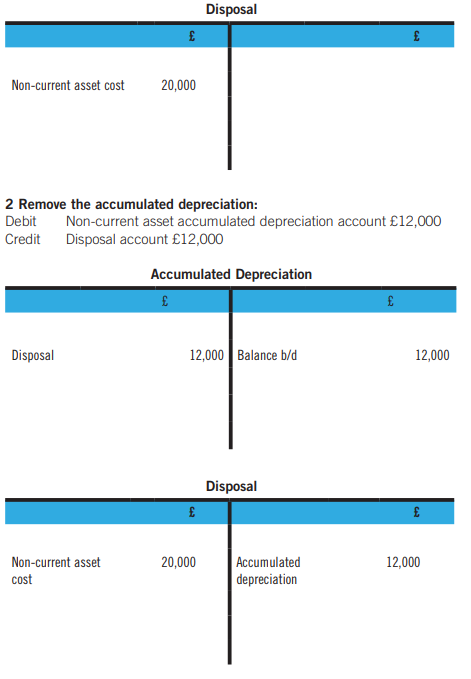

1 Remove the cost of the disposed asset: Debit Disposal account Credit Non-current asset account.

2 Remove the accumulated depreciation: Debit Non-current asset accumulated depreciation account Credit Disposal account.

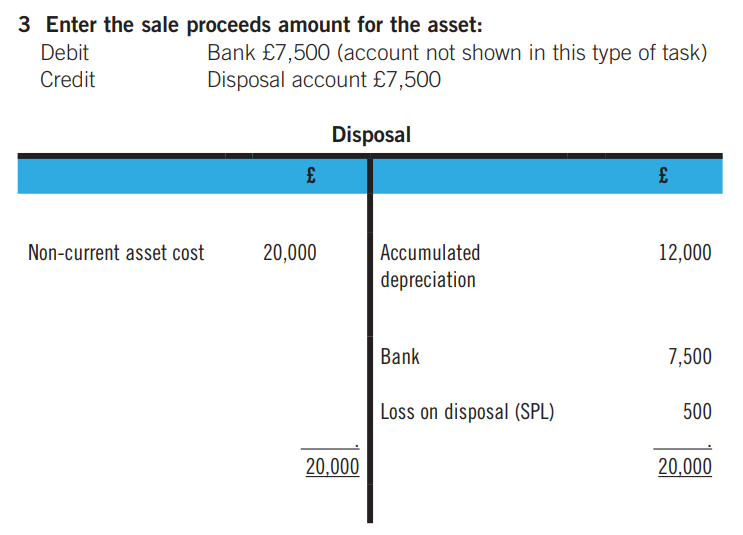

3 Enter the sale proceeds amount for the asset: Debit Bank (or Receivables) Credit Disposal account.

At this stage the disposals account is balanced to see if a profit or loss has been made on the disposal.

We will look at an example question, and the way this should be approached.

Example

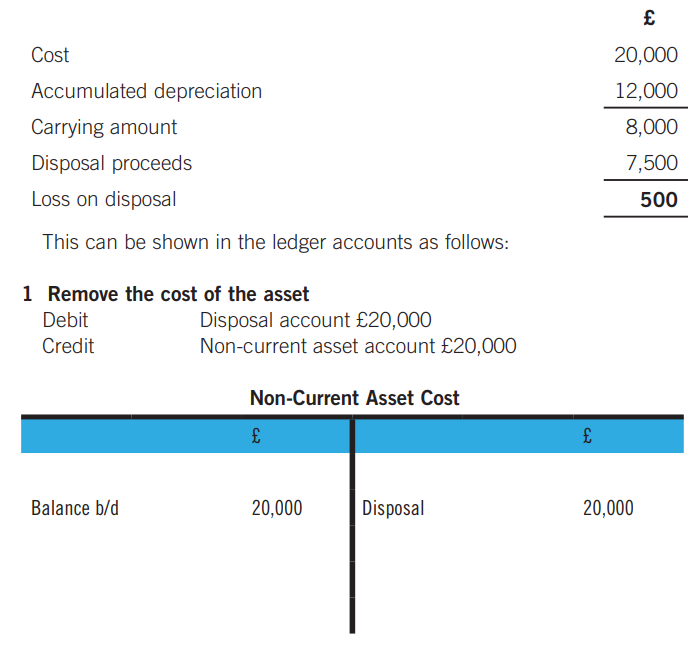

EC Limited had a non-current asset costing £20,000 with accumulated depreciation of £12,000.

The asset had been sold for £7,500 and a bank receipt for the sale had been received.

To calculate the profit or loss on disposal:

The loss on disposal is then debited to the statement of profit or loss, as this represents a loss on disposal. If, however, there had been a profit on disposal, a credit entry would be made to the profit or loss instead.

Now have a go!

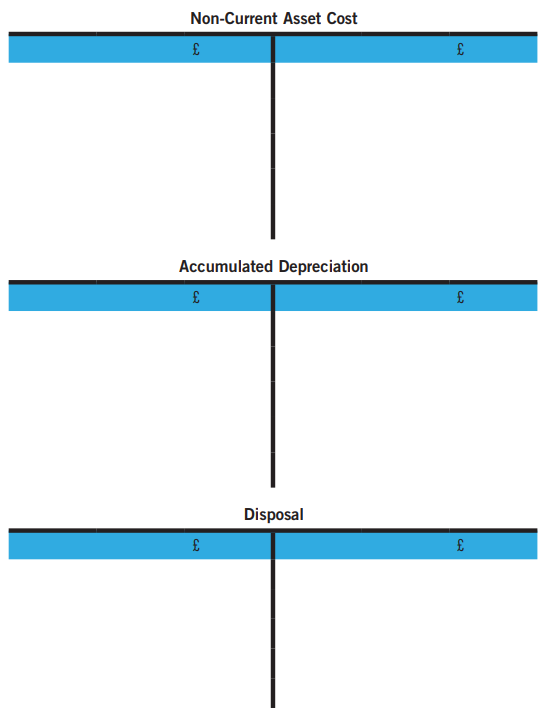

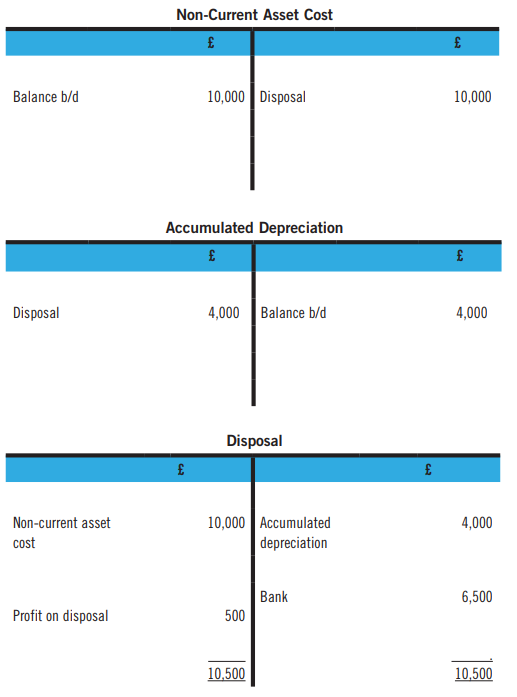

EC Limited had a non-current asset costing £10,000 with accumulated depreciation of £4,000.

The asset had been sold for £6,500 and a bank receipt for the sale had been received.

Show the entries to be made in the ledger accounts.

Answer

•Karen Groves is an AAT tutor and AAT Course Director at e-Careers