May 2020

Zahid Ahmed explains all you need to know about the Enterprise Investment Scheme, the Seed Enterprise Investment Scheme, and venture capital trusts.

One of the areas examined at the Advanced Taxation level is the interaction of taxes & the impact of them in various situations. Many students tend to forget how an investment will impact multiple taxes.

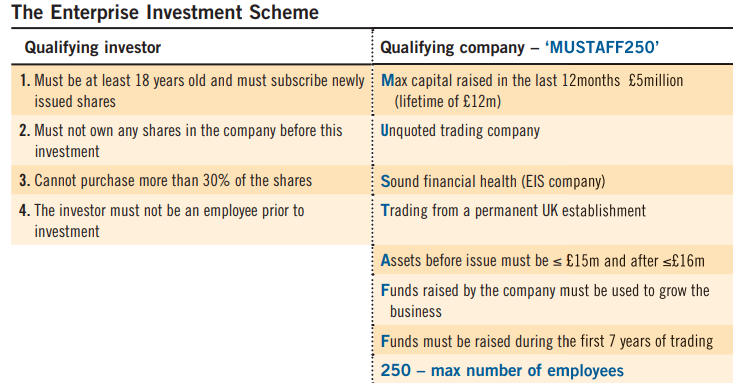

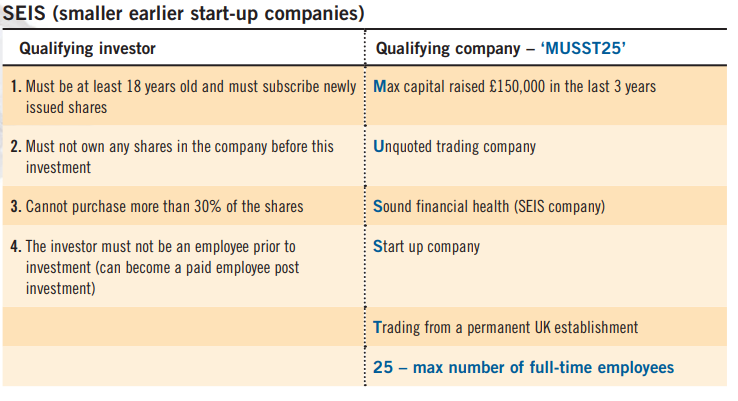

The Enterprise Investment Scheme (EIS) and the Seed Enterprise Investment Scheme (SEIS) were introduced to encourage direct investments in unquoted start-up companies. SEIS companies are similar to EIS ones, but normally they tend to be smaller and at an earlier stage of their trading cycle, and as such they bear more risk, which means more relief across CGT and IT.

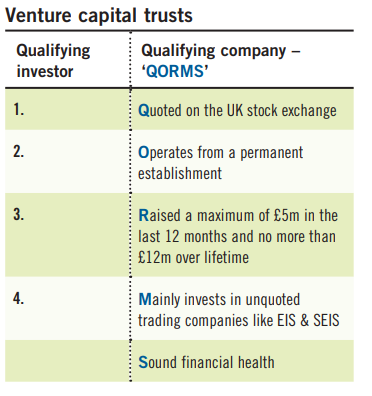

Venture capital trusts (VCTs), on the other hand, were introduced on the back of EIS and SEIS to encourage indirect investments in such companies. In short, a venture capital trust will do the ground research for you – like a fund manager.

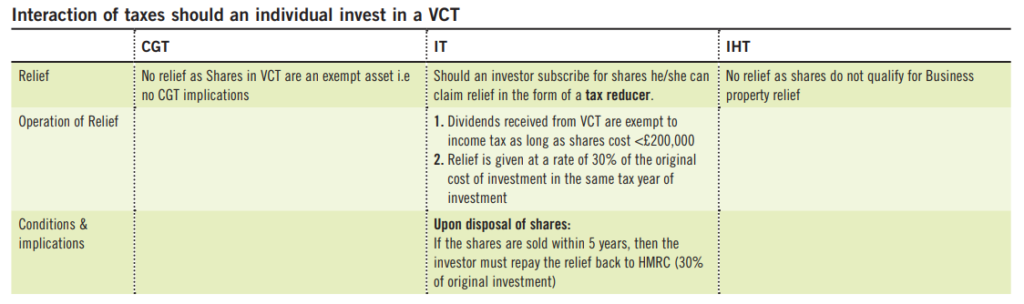

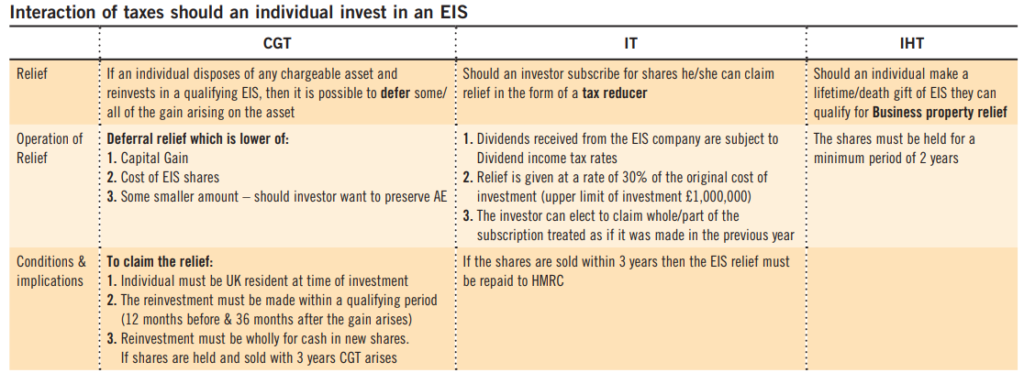

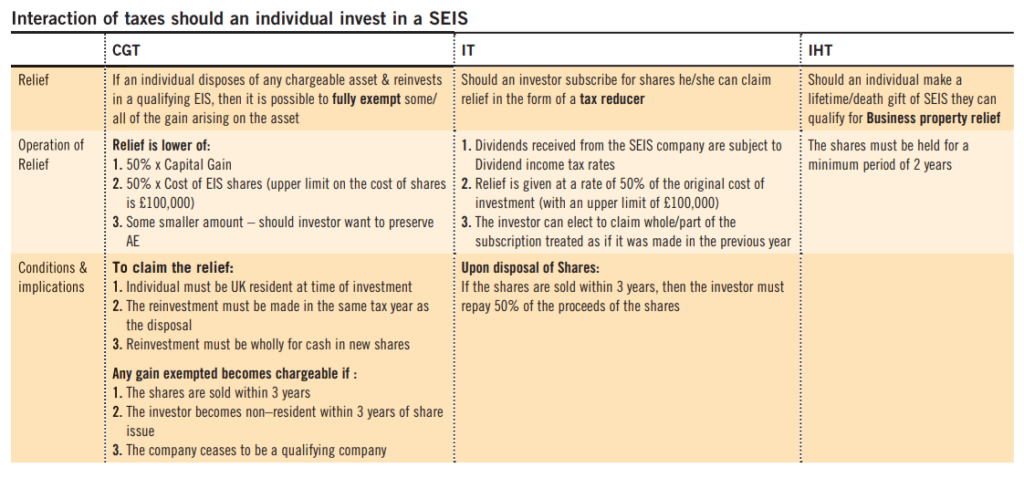

Now let’s consider a scenario where an individual has made a chargeable disposal and would like to invest in either an EIS, SEIS or VCT, but is unsure of the benefits/drawbacks of each scheme. This article will consider the impact of capital gains tax, income tax and inheritance tax in such scenarios.

As you can see an investment in an EIS, SEIS or VCT will impact multiple taxes, and students should bear the above in mind when answering questions on this.

• Zahid Ahmed is a tutor at LSBF