The UK’s tax gap for the 2019/20 tax year has gone up ever so slightly by 0.6% to 5.3%, according to the latest figures from HMRC.

We are told that some 43% (£15.1 billion) of the tax gap is attributed to small businesses, whereas wealthy customers and individuals account for the smallest share at 4% (£1.5 billion) and 7% (£2.6 billion) respectively.

HMRC said that There has been a long-term reduction in the overall tax gap, falling from 7.5% in 2005/06 to 5.3% in 2019/20, and it feels that the tax gap has remained low and fairly stable for the last four years.

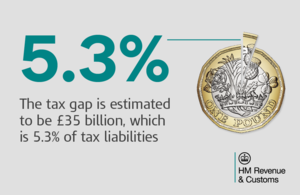

This year’s estimated tax gap at 5.3% represents £35 billion compared to 5% in the 2018/19 tax year, which amounted to £33 billion in monetary terms.

Nearly 95% of the tax due was paid in 2019/20, and HMRC has seen an increase in total revenue paid year on year. Taxpayers paid more than £633.4 billion in tax during 2019-20.